Abstract

This study employs a laboratory experiment to assess the performance of tradable permit markets on dynamic efficiency arising from cost-reducing investment. The permit allocation rule is the main treatment variable, with permits being fully auctioned or grandfathered. The experimental results show significant investment under both allocation rules in the presence of ex ante uncertainty over the actual investment outcome. However, auctioning permits generally provides stronger incentives to invest in R&D, leading to greater dynamic efficiency compared to grandfathering.

Similar content being viewed by others

1 Introduction

Emissions trading schemes are increasingly being employed across the globe as a prominent market-based environmental policy instrument to curtail emissions cost-effectively. Competitive emissions trading programs can equalize marginal abatement costs (MAC) across firms so that the abatement target is reached efficiently. Alongside this general static efficiency result, however, is sparse evidence concerning the incentives that tradable permit markets create for investment in the development of advanced abatement technology. Our study aims to fill this gap by providing experimental evidence on such investment behaviour, providing some initial empirical insight into the dynamic efficiency performance of tradable permit markets.

Technological innovation is important for pursuing sustainability in many pollution control problems. Following Kneese and Schultze (1975), who stressed the importance of understanding the long run impacts of policy on developing and adopting environmentally benign technologies, a considerable theoretical literature has emerged trying to rank different policy instruments, especially with respect to the incentives for technology adoption and diffusion (see, e.g., Requate 2005). Only a very limited number of papers have examined the inducement effects of policy on investment in research and development (R&D).

Montero (2002) theoretically analyses how grandfathered and auctioned permits (alongside standards) induce firms to invest in environmental R&D. Assuming homogeneous firms, Montero finds that grandfathering and auctioning generate equal R&D incentives when both permit and output markets are competitive. This contrasts with Cramton and Kerr (2002) who argue that emissions trading schemes where permits are auctioned would feature a stronger dynamic efficiency performance compared to markets where permits are allocated based on grandfathering. Their argument follows from the existence of two effects: an abatement cost effect and an emissions payment effect (Fischer et al. 2003). The former effect refers to the lower MAC from innovation; the latter effect reflects the downward pressure of innovation on the equilibrium permit price, hence reducing scarcity rents. The emissions payment effect implies that the benefit from innovation due to innovators’ (successful) investment spills over to non-innovating firms. Under auctioning, this benefit translates into a lower price that non-innovators pay for permits to cover their emissions. The emissions payment effect is non-existent under grandfathering, because in the aggregate the gains and losses to net buyers and sellers cancel out. Therefore, a permit system based on auctioning would provide stronger innovation incentives given the absence of scarcity rents to innovating firms.Footnote 1

The allocation mechanism is a key issue in view of design, implementation and potential (dynamic) efficiency of many different types of markets, ranging from rights-based fisheries management (Anderson et al. 2011) to emissions trading (Lyon 1982; Goeree et al. 2010; Grimm and Ilieva 2013). For instance, the European Union Emissions Trading System (EU ETS) is currently transitioning from mostly grandfathered to mostly auctioned permits. Botelho et al. (2011) study the EU ETS market institution in the laboratory by comparing the performance under a full auctioning and full grandfathering rule, and they provide experimental evidence showing that total abatement costs are similar under both allocation mechanisms. This finding confirms the standard static efficiency result mentioned above. Moreover, their study also shows that auctioning can allocate permits more accurately across sources. This allows sources to reach the minimum abatement cost solution more effectively because less post-allocation permit trade between sources is required.

The way that permits are allocated across sources may also affect the incentives to invest in R&D. A novel feature of our emissions trading experiment is the introduction of R&D investment to lower MAC. Given the lack of detail in investment data from existing field markets (such as the EU ETS), our study can be helpful in assessing the implications from changing the allocation rules on R&D investment behaviour. It can also more cleanly identify causality, which is challenging in the field due to endogenous policy choices.

To investigate this issue experimentally, our study exogenously varies the permit allocation mechanism as the main treatment variable. However, since investment directed at advancing pollution abatement technology is typically associated with uncertainty (e.g., Weber and Neuhoff 2010), the novelty of our study involves the inclusion of a stochastic impact of R&D investment on the MAC reduction. Alongside innovators’ assessment of future market conditions, it is the inherent uncertainty associated with R&D investment that seems to have played an important role in the decline—and perhaps under-investment—in inventive activity under two flagship cap-and-trade schemes in the United States: the SO2 emissions trading market and the NOx budget program (Taylor 2012). Our experimental permit market thus enables us to identify specifically the causal impact of the permit allocation mechanism on dynamic efficiency when the cost-reducing effects of R&D are non-deterministic, albeit in a stylized but carefully controlled laboratory environment.

Cost uncertainty and the aforementioned emissions payment effect gives rise to stochastic permit prices. In a real options model, Zhao (2003) theoretically addresses this interdependency under a tradable permit system with grandfathering as well as emission charges and finds that abatement cost uncertainties reduce the investment incentives of firms. In a laboratory setting, Ben-David et al. (1999) study the functioning of a tradable permit market by varying the degree of cost heterogeneity regarding abatement technology. Their study shows that increased cost heterogeneity does not have a significant impact on trade volume, although they do find some evidence of reduced trading volume from higher price variability. Overall they find that market efficiency is inversely related to abatement cost heterogeneity. In a follow-up study, Ben-David et al. (2000) explore in an experimental tradable permit market (under grandfathering) the impact of uncertainty on permit prices, trading volume and abatement levels assuming irreversible investment in abatement technology. Alongside uncertainty regarding the timing of a reduced permit allocation, they include treatments that vary the size of the increased stringency through a tighter emissions cap. They observe no impact of these uncertainties on trade volumes and permit prices. Ben-David et al. (2000) argue that the irreversible nature of investment in abatement technology may be one of the reasons that permit buyers may delay their decisions to invest and abate less until they obtain more knowledge about the uncertainty in future periods. Our experiment extends their study by introducing uncertainty about the cost-reducing impact from innovation through R&D investment decisions. Moreover, the earlier research implements a random but exogenous permit price, hence ignoring the aforementioned emissions payment effect from innovation. By contrast, in our experimental market the permit price is endogenously determined through market trading and it depends on the R&D investment decisions made by all firms.

Closer to our study, Camacho-Cuena et al. (2011) compare the adoption incentives of advanced abatement technology in an emissions trading experiment under permit auctioning and grandfathering. Their results reveal the absence of an adoption differential and show that both auctioning and grandfathering are equivalent for static and dynamic efficiency. More recently, Taschini et al. (2014) explore the timing of (irreversible) adoption decisions of abatement technology in the laboratory under a grandfathering allocation rule only. The authors build in abatement cost uncertainty by assuming that emissions are stochastic. In such a setting, Taschini et al. find that firms tend to invest in the adoption of abatement technology faster when a strict enforcement mechanism is in place that penalizes firms when facing emissions in excess of permit holdings. Suter et al. (2013) also focus on adoption of existing technology, but in a context of water quality trading markets featuring a limited number of firms, and they show that traders tend to over-invest in technology that requires (large) capital investments. This over-investment holds especially for those traders who experience more restricted abatement opportunities due to their use of high-cost abatement technology. Over-investment is also found in Gangadharan et al. (2013), who examine the role of banking in conjunction with opportunities to invest in abatement technology and uncertainty about the future permit allocation. In a tradable permit market experiment based on a grandfathering allocation rule, one of their key findings is that in situations where both banking and investment is allowed, the degree of over-banking is reduced relative to a treatment with only the option to bank.

Our paper extends the above research by concentrating on the interaction between the permit allocation mechanism and the R&D investment decisions by explicitly acknowledging the stochastic nature of R&D investment rather than stochastic emissions as in Taschini et al. (2014). In our experimental analysis we compare the economic gains from actual investment levels to the gains from R&D choices that lower abatement costs efficiently by optimally trading off marginal investment costs and marginal impacts on abatement and permit prices. Like Suter et al. (2013) and Gangadharan et al. (2013), traders over-invest in new technology, and this occurs in both allocation mechanism treatments. Contrary to the study of Camacho-Cuena et al. (2011) on technology adoption, in our experimental permit market with stochastic R&D we find that auctioning results in significantly greater R&D investment compared to grandfathering.

This outcome could be driven by the fact that our permit markets are not strictly perfectly competitive, as permit prices and transaction volumes sometimes deviate from competitive equilibrium levels, as well as misperceptions about opportunity costs compared to explicit costs. More precisely, under auctioning every single trader is a permit buyer and benefits from lower abatement costs and lower permit prices driven through successful R&D investment, i.e., the strategic effect is positive for each trader. In contrast, under grandfathering traders who are permit sellers suffer from a lower permit price when R&D investment is successful, i.e., the strategic effect is negative for permit sellers and positive for permit buyers. Sellers should recognize that the lower permit prices reduce their opportunity costs of compliance, just as these lower prices reduce the buyers’ explicit compliance cost. Existing experimental evidence indicates, however, that people treat realized gains and losses differently from opportunity costs (Lind and Plott 1991) and they must learn to react properly towards opportunity costs (Wråke et al. 2010). The symmetry in the trader pool composition leads to stronger overall R&D investment incentives with auctioning—relative to grandfathering—in a strategic market environment. This finding is in line with one of the theoretical results obtained by Montero (2002), suggesting that when both the permit and output market are imperfectly competitive, auctioning provides more R&D incentives than grandfathered permits. However, as our theoretical model does not include an output market, our experimental evidence is accordingly obtained without any consideration of output market effects.

2 Theoretical Model

This section presents a theoretical model which allows us to investigate the interdependence between abatement costs, investment in R&D and permit price discovery. Our model builds on Ben-David et al. (2000) but we extend it in two important dimensions. First, in addition to the abatement decision, our model also includes the opportunity for firms to invest in R&D. This investment may (or may not) potentially reduce a firm’s abatement costs. Second, rather than treating the permit price as a random and exogenous variable, allowing for investment opportunities leads the permit price to become endogenous, as it is contingent on the realized impact of investment on the firms’ MAC functions.

Consider \( i = 1, \ldots ,n \) firms that can choose their level of emissions abatement \( q_{i} \ge 0 \). The function \( a_{i} \left( {q_{i} } \right) \) refers to firm i’s MAC. Further, let \( x_{i} \ge 0 \) denote the level of firm i’s R&D investment. Investment in R&D comes at a cost, \( C\left( {x_{i} } \right) \), but it can potentially lead to a reduction in the MAC. Accordingly, the MAC function can be written as:

Further, denote \( p\left( {\mathbf{x}} \right) \) as the permit price, which is established in the tradable permit market and with \( {\mathbf{x}} = \left( {x_{1} ,x_{2} , \ldots ,x_{n} } \right) \) defining the vector of investments.

Let us first consider the situation without investment uncertainty. In this case firm i’s (net) payoff reads:

with \( R_{i} \) being an exogenous revenue a firm obtains in the output market and \( q^{a} \) representing the amount of abatement in the absence of permit trading. The second term represents the firm’s permit revenue (costs) when \( q_{i} > \left( < \right) q^{a} \). The third and fourth term reflect total abatement costs and the R&D investment costs, respectively.

However, firms typically face uncertain future permit prices, and this influences (optimal) abatement decisions in the current period. That is, technological innovation can alter the shape and level of the MAC function, which subsequently affects equilibrium permit prices in future periods. This, in turn, impacts on optimal abatement levels and overall net payoffs. Allowing for uncertainty regarding the impact of R&D investment on abatement costs, we can now write the MAC function (1) as:

with \( \theta_{i} \) measuring the extent by which the MAC depends on R&D investment. Assuming \( \theta_{i} \) has a probability distribution \( g\left( {\theta_{i} } \right) \), Eq. (2) can be rewritten as follows:

In a given period, each firm maximizes expected utility as shown by Eq. (4). For convenience, let us write \( F\left( {q_{i} ,x_{i} } \right) = {\mathbb{E}}U\left[ {\Pi _{i} \left( {q_{i} ,x_{i} } \right)} \right] \). The first-order conditions (see Appendix A.1 for derivations) with respect to abatement and R&D investment are now respectivelyFootnote 2:

Next, let us derive more explicit first-order conditions by imposing some assumptions on the firms’ risk attitudes. In particular, we shall assume that firms are risk neutral, implying \( U =\Pi \).Footnote 3 Equations (5a) and (5b) then become:

From (6a) we observe the standard result that the optimal level of abatement is where the expected MAC is equal to the expected permit price. For the R&D investment characterized in Eq. (6b), optimality requires that the expected permit price minus the marginal reduction in abatement costs is equal to the marginal cost of R&D investment. First-order conditions (6a) and (6b) must simultaneously hold in equilibrium.

A key element in the model is the uncertainty surrounding the size of the MAC reduction, as reflected by Eq. (3). Even though expected abatement costs are decreasing in R&D investment (\( \partial a_{i} /\partial x_{i} < 0 \)), given the inherent uncertainty of the R&D process, firms typically do not know the actual size of this decrease at the time of their investment decision. A simple and transparent way to model this potential change in MAC is by a step function of \( \theta_{i} \). For instance, assume that \( \theta_{i} \) is uniformly distributed between 0 and 1 with a threshold level \( h\left( {x_{i} } \right) \). Given firm i’s investment in R&D, its MAC function corresponds to:

with \( \Delta > 0 \) being the fixed per-unit reduction and \( f_{i} \left( {q_{i} } \right) \) referring to the firm’s original MAC function. Thus, the MAC function changes to \( f_{i} \left( {q_{i} } \right) - \Delta \) with a probability that increases with the level of investment, or does not change otherwise. In choosing the investment function \( h\left( {x_{i} } \right) \) for the experimental implementation, we follow the empirical finding that there are diminishing returns to investment (e.g., Popp 2005). A simple function that exhibits this behaviour is:

where \( \beta > 0. \)Footnote 4 It directly follows from (8) that the probability of success from a marginal increase in investment is positive \( (h^{\prime}\left( {x_{i} } \right) > 0) \) but at a decreasing rate \( (h^{\prime\prime}\left( {x_{i} } \right) < 0) \).

It is important to highlight that the investment decision in our model is independent of the actual permit allocation. This is in line with one of the theoretical predictions in Montero (2002), arguing that in competitive permit markets the initial allocation does not affect R&D investments. This implies that grandfathering and auctioning provide equal investment incentives. The fundamental argument driving this result is the theoretical equivalence of the costs incurred on permits acquired through auctioning with the opportunity costs of permits received through grandfathering. Since the permit allocation does not enter the investment decision, we do not have to worry about whether or not permits are (sub)optimally distributed prior to the time of investment in the case of grandfathering.

3 Experimental Design and Hypotheses

3.1 Design and Laboratory Procedures

A total of 20 sessions were conducted with the permit allocation mechanism being the main treatment variable. The experimental design implemented a balanced panel, implying that in 10 of the sessions the permits were allocated via grandfathering and in the remaining 10 sessions permits were allocated via auctioning (throughout the rest of the paper we refer to this auction as the “allocation auction”). Let us refer to the grandfathering treatment as G and the auction treatment as A. Each session included 8 traders of which 4 faced high abatement costs and 4 faced low abatement costs. Denote the high-cost type and the low-cost type traders as H and L, respectively. The difference in MAC is the only source of heterogeneity across traders. Table 1 shows the initially assigned pre-R&D MAC for the high-cost and low-cost type. Figure 1 accordingly displays the aggregate pre-R&D MAC function, with the equilibrium permit price range indicated by the red dotted horizontal lines.

In each session, all eight traders make R&D investment decisions and trade permits in a computerized double auction market in 12 successive periods.Footnote 5 The subjects were all undergraduate students at Purdue University, which is also where the experiment was conducted. The z-Tree program (Fischbacher 2007) was used for the implementation of the experiment. For the purpose of maintaining experimental control as much as possible, we used neutral framing in the experiment and did not refer to the specific environmental economics setting explicitly, since these could affect subjects’ preferences differently (Cason and Raymond 2011). In this respect, tradable emission permits were referred to as “coupons,” and abatement and MAC were referred to as “production” and “production costs,” respectively.

We use a two-stage model, since this is the simplest environment in which dynamic effects arise. This two-stage approach allows for a much simpler experimental design, compared to an alternative designed to mimic an infinite horizon. It also allows for more straightforward data analysis, since the data are always organized as two-stage blocks (Agranov et al. 2016). This approach seems particularly suited for an experiment designed to identify and compare such dynamic effects from investment across treatments. In particular, each single trading period is divided into two trading Stages: I and II. The length of the period and the different trading Stages is common knowledge amongst traders. Figure 2 summarizes these two stages as well as the timing of the above outlined events within a single period. Let us outline these events in detail.

At the start of trading Stage I, fixed revenues and permits are distributed to traders. Depending on the treatment, the distribution of permits occurs via either grandfathering or the allocation auction. In the G-treatment 2 permits are allocated to type H traders and 6 permits to the type L traders. This asymmetric initial allocation induces the high-cost type to be (net) permit buyers and the low-cost type to be (net) permit sellers in equilibrium. To equalize MAC across firm types, in equilibrium each firm would need to buy (if type H) or sell (if type L) five permits. In contrast to the G-treatment, in the A-treatment we do not fix the specific permit endowment but traders can buy any number of permits subject to the constraint that the aggregate permit supply cannot exceed 32. Following the same auction format as is applied in the EU ETS, permits are allocated in a uniform price, sealed-bid auction.Footnote 6 When auctioning off the 32 permits, all permits are sold at a uniform price set by the lowest accepted bid (with any ties broken randomly). Moreover, bidders in the EU ETS auction can place multiple bids. This implies that bidders can enter a bid schedule and are not restricted to bid for a single price-quantity combination. To implement this rule in our allocation auction, traders can only buy up to a maximum of 10 permits, and they can submit a different price for each permit bid they make.

After the permits are allocated in Stage I, traders have the opportunity to buy and sell them in the (continuous) double auction market so as to adjust their permit holdings if they wish. Trading of permits in this reconciliation market lasts for 2 minutes. The double auction market provides a competitive environment where traders are free to submit public offers to purchase and sell permits at a certain price. Throughout the 2-minute transaction time, traders can adjust their offers but new offers must be an improvement over previous offers. That is, any new buy offers must be higher than the current highest buy offer and any new sell offers must be lower than the current lowest sell offer. The equilibrium permit price, \( p^{*} \), is in the range [135,138] given a total supply of 32 permits in the market (see Fig. 1). This is also the relevant equilibrium price range in the A-treatment. However, the equilibrium trading volume is conditional on who acquired the permits in the allocation auction.

Upon completion of Stage I, traders enter trading Stage II. The key difference from trading in the first Stage is that traders now have the opportunity to invest in R&D. Before the R&D investment decisions are made, permits are again allocated either on the basis of grandfathering or auctioning, depending on the treatment. This timing of the permit allocation prior to the actual investment decision allows traders to reap the benefits from their investment in the reconciliation market, i.e., the double auction trading opportunity in Stage II (see Fig. 2).

Following the new allocation of permits, traders make investment decisions. This investment may or may not lower a trader’s MAC, implying that the outcome of investment is uncertain. Following Eq. (7), the marginal cost for each unit abated is reduced by a fixed amount in case investment is successful. In particular, it leads to a shift down in the MAC schedule by 50 Experimental dollars per unit of abatement. In the experiment traders can only invest discrete amounts in units of 10 with a lower limit of zero investment and an upper investment level of 90, i.e., the permissible levels of R&D investment are \( x_{i} \in \left\{ {0, 10, 20, \ldots ,90} \right\} \). The investment cost function used in the experiment reads \( C\left( {x_{i} } \right) = x_{i}^{2} /25 \). Using Eq. (8) and \( \beta = 50 \), an investment \( x_{i} \) leads to a probability of successful innovation of \( h\left( {x_{i} } \right) = x_{i} /\left( {50 + x_{i} } \right) \). After the investment choices, traders learn whether or not the investment was successful in lowering abatement costs. The traders’ investment decisions lead to a new realized abatement cost profile across traders of each type, which is contingent on the number \( N_{k} \)\( \left( {k = H,L} \right) \) of successful abatement cost reductions. Compared to Stage I, the (equilibrium) permit prices in the allocation auction depend on the expected abatement costs because this allocation occurs before traders make R&D investments.

After finishing a single period each trader’s abatement costs return again to their original (higher) level. This implements conditions of stationary repetition—a standard design feature of market experiments—across the two-stage cycle for the 12 successive periods. This allowed subjects to gain experience in trading before and after innovation. It also provides traders with useful information about post-innovation permit prices in Stage II, enabling them to learn the value of R&D investment. Note that permits can neither be carried over from Stage I to Stage II nor can be carried over into a new period.

All eight traders make their R&D investment choice simultaneously. We numerically calculated the Nash equilibrium of this investment game based on the MAC schedules, the reduction in abatement costs arising from successful innovation, the R&D costs \( C\left( {x_{i} } \right) \) and the innovation success function \( h\left( {x_{i} } \right) \). All traders who share identical abatement cost types (H-type and L-type; see Table 1) have the same best-response function and we determined the quasi-symmetric equilibrium in which all traders within each type choose the same investment level. For every pair of investment levels \( \left\{ {x_{H} , x_{L} } \right\} \), the innovation success function \( h\left( {x_{i} } \right) \) implies a probability distribution over 25 different combinations of innovators, i.e., the number of successes for each of the two types. Each of these 25 combinations of innovation successes leads to a new aggregate MAC schedule. Given the fixed supply of 32 permits, every combination of investment levels \( \left\{ {x_{H} , x_{L} } \right\} \) therefore leads to a probability distribution over 25 competitive equilibrium prices.Footnote 7 Each of these equilibrium prices generates a particular profit for a trader given her type and whether she was one of the successful innovators. We calculated the conditional probability that each trader of each type innovated for all 25 combinations of innovation successes, and used this and the R&D costs \( C\left( {x_{i} } \right) \) to calculate the expected returns from each investment level \( x_{i} \) given the investment choices of others. This determined the best-response function for each trader type, which depends on the permit market returns from innovation. It turns out that the unique Nash equilibrium involves identical investments by both types, \( x_{H}^{*} = x_{L}^{*} = 30 \).Footnote 8

Although the investment returns are different for the two trader types, due to their differences in MAC, these Nash equilibrium investment levels do not depend on either the method (grandfathering or auctioning) or actual realized permit allocation. The opportunity cost of a permit is the same for all traders regardless of who possesses the permit. Note also that these equilibrium investment levels do not account for the social benefits from investment, which assumes that there are no direct spillovers from investment from innovators to non-innovators. We do not include these spillovers to avoid adding more complexity to the experiment. However, a standard result from the industrial organization literature indicates that there would be under-investment in R&D (relative to the socially optimal level of investment) if innovators are unable to capture part of the spillovers from their investment. Allowing for investment spillovers would therefore imply that the optimal levels of R&D investment could be higher than the Nash investment levels of 30.

These Nash investment levels lead each firm to successfully lower its abatement costs with probability 0.375. Based on this equilibrium investment level, and the expected distribution of R&D success, equilibrium prices in the allocation auction range between 119 and 122. Stage II concludes with a permit trading stage where traders can buy and sell permits in the reconciliation market. In contrast to the outcomes in the Stage I reconciliation market, permit prices and trading volumes in the reconciliation market in Stage II are now also conditional on the realized R&D success, as measured by \( N_{k} \). This applies to both the G-treatment and A-treatment. In the A-treatment, traders’ individual permit volumes and the corresponding aggregate market volume depends also on the outcome of the initial allocation auction.

Each session lasted about 90–100 min and after each session money was paid out privately in cash following a conversion at a rate of 800 Experimental$ = 1 US$. On average, subjects earned $31.09 per person.

3.2 Testable Hypotheses

A focal point in our theoretical model and experimental design is the interrelationship between the R&D investment decision and the resulting expected permit price, which is endogenously determined by the stochastic nature of the R&D investment of all firms participating in the permit market. The setup of the theoretical model and corresponding experimental design allows us to test several hypotheses. Given our primary focus on R&D investment, we first study the impact of auctioning and grandfathering on the permit market’s dynamic efficiency. For this we follow the standard dynamic efficiency concept from industrial organisation, which refers to the reduction of the relevant cost functions (in our case abatement costs) over time (e.g., Qiu 1997). In particular, we use a straightforward positive measure of dynamic efficiency, the actual level of R&D investments induced under the different allocation mechanisms. In addition to investment incentives, our experimental design also enables us to test hypotheses related to permit prices and permit transaction volumes. Based on the discussion in the previous section, we can now draw the following hypotheses:

Hypothesis 1

(Dynamic efficiency) In a competitive permit market,

-

(a)

R&D investments levels are the same for the high-cost (H-type) and low-cost (L-type) firm;

-

(b)

R&D investment levels are equal across the A-treatment and G-treatment and are equal to the Nash equilibrium of 30, resulting in equivalent dynamic efficiency.

Hypothesis 2

(Stage I prices) In Stage I, transaction prices are in the equilibrium range 135–138. This holds for:

-

(a)

The allocation auction in the A-treatment;

-

(b)

The double auction reconciliation market in both the A-treatment and G-treatment, in which

-

(c)

Transaction prices are equal across the A-treatment and G-treatment.

Hypothesis 3

(Stage II prices) In Stage II,

-

(a)

Permit prices are lower than in Stage I both in the allocation auction in the A-treatment as well as the double auction reconciliation market in both the A-treatment and G-treatment;

-

(b)

Allocation auction prices in the A-treatment are in the equilibrium range 119–122;

-

(c)

Double auction reconciliation market prices are equal to equilibrium levels and are conditional on realized cost reductions from R&D.

Hypothesis 4

(Allocation auction transaction volume) High-cost (H-type) firms buy more permits in the allocation auction than low-cost (L-type) firms both in Stage I and Stage II.

Hypothesis 5

(Reconciliation transaction volume) Net transaction volume per firm in the double auction reconciliation market is:

-

(a)

5 units in the G-treatment in Stage I;

-

(b)

Lower in the A-treatment than in the G-treatment in both Stage I and Stage II;

-

(c)

Greater in Stage II than in Stage I in the A-treatment.

4 Results

This section presents the experimental results organized around the five hypotheses as outlined above. Section 4.1 focuses on R&D investment and dynamic efficiency, Sect. 4.2 on permit transaction prices, and Sect. 4 on permit transaction volumes. Table 2 summarizes the point predictions of the market outcome measures as well as the predictions provided by the competitive and Nash equilibrium. All nonparametric (Wilcoxon and Mann–Whitney) tests employ statistically independent sessions of 8 traders as the unit of observation. Statistical results are based on all 12 trading periods. Except for the marginal difference noted below in Sect. 4.1, conclusions are unchanged when considering only the final 6 periods after traders have had an opportunity to learn and adjust beliefs and behavior.

Before going into the experimental results in more detail, let us first provide some intuitive guidance behind the dynamic processes that govern the stochastic nature of investment decisions and its impact on permit prices. As outlined in Sect. 3.1, we capture this interaction through an experimental design featuring a 2-stage cycle repeated each period. Figures 3 and 4 illustrate the permit price dynamics in such a setting with predicted prices always in the 135–138 range for Stage I and then dropping to different—but always lower—levels in Stage II depending on the level of R&D success. Figures 3 and 4 also show that permit price behavior can be inherently different under grandfathering and auctioning. More specifically, prices tend to be more accurate and less volatile when permits are auctioned (see Fig. 4) than grandfathered (see Fig. 3). Reconciliation market volume is also much lower when permits are auctioned rather than grandfathered, and this can be seen in the Figs. 3 and 4 as each dot represents a unique transaction. This outcome is expected since (efficient) auctioning guides the allocation of permits to traders according to their marginal valuation of emissions, whilst under grandfathering this marginal valuation for covering emissions is, a priori, unknown at the time of allocating permits. Therefore, less adjustment in terms of permit holdings is required under auctioning in the reconciliation market. Furthermore, trade volume in the reconciliation market in Stage I and II is likely to be different under auctioning. Compared to Stage I, more adjustment of permit holdings is required in Stage II due to the stochastic realization of a new MAC profile across traders. This stochastic impact from investment is absent in Stage I, and no new information arrives that would require reconciliation following the allocation auction.

4.1 R&D Investment and Dynamic Efficiency

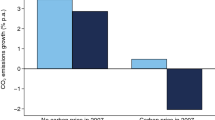

Based on the theoretical model and the numerical implementation in the experiment, and using competitive equilibrium permit prices, the Nash equilibrium investment choices are 30 for both the H-type and L-type firms. Figure 5 illustrates that actual investment choices tend to exceed this level. In particular, 83% and 73% of investments exceed 30 in the A-treatment and G-treatment, respectively. Average investments are 51.8 in the A-treatment and 45.3 in the G-treatment, which both significantly exceed the equilibrium of 30 (Wilcoxon signed-rank test p-values < 0.01 in both cases). Average investments are also significantly greater in the A-treatment than the G-treatment (Mann–Whitney rank-sum test p value 0.02).Footnote 9

This main result is confirmed by panel regressions in Table 3 that include random subject effects and report standard errors that are robust to session clustering. The top row indicates the significant Grandfathering treatment effect, even when controlling for a time trend and previous permit prices and individual expenditures, as well as previous investment success. Although both the H-type and L-type have similar investment incentives, the H-type tend to invest less than the L-type, by about 4 to 7 on average, as indicated in the second row.Footnote 10

As Fig. 5 illustrates, on average actual investment exceeds the equilibrium level. One possible explanation of this over-investment is that the expected losses from suboptimal investment are about 3 to 4 times larger at the margin for under-investment compared to over-investment for the investment cost function used in the experiment. Thus, a model of rational errors would more often feature above- than below-equilibrium investments (e.g., in a quantal response equilibrium; see Goeree et al. 2016). As noted above, the Nash equilibrium investment choice of 30 does not account for the (unmodeled) social benefit of R&D spillovers, which are not captured by the innovator. Consequently, this over-investment has a positive impact on dynamic efficiency, and these efficiency gains are greater in the A-treatment because of its significantly greater R&D investment level. The overall results concerning investment incentives and dynamic efficiency are as follows and run counter to Hypothesis 1:

Result 1

-

(i)

H-type firms tend to invest less in R&D than L-type firms in both the G-treatment and A-treatment, contrary to Hypothesis1(a).

-

(ii)

Actual R&D investment levels are significantly higher than the equilibrium R&D investment level, both in the G-treatment and A-treatment. This is inconsistent with Hypothesis1(b).

-

(iii)

Investment in R&D and dynamic efficiency is greater under auctioning than under grandfathering. This is inconsistent with Hypothesis1(b).

4.1.1 Permit Prices

Figure 6 displays the mean double auction transaction prices for Stage I trading across all 12 periods and pooled across all sessions. In the G-treatment, prices start above the equilibrium range and then trend downward, settling in slightly below the competitive level. Prices start lower in the A-treatment, but after 4 periods they rise to the equilibrium level before also drifting down below this theoretical benchmark. Similarly, average prices in the allocation auction also start below the equilibrium and rise across periods, as shown in Fig. 7. Based on nonparametric Wilcoxon and Mann–Whitney tests we can state the following result:

Result 2

-

(i)

In the A-treatment, the average permit prices in the allocation auction in Stage I range widely with a mean of 122.0 (median 120), and this mean rises over the first 6 periods. Average prices are significantly below the equilibrium prediction of 135–138, contrary to Hypothesis2(a).

-

(ii)

Double auction reconciliation prices are (not) significantly different from the equilibrium range 135–138 in the A-treatment (G-treatment). These average prices are not significantly different in the A-treatment and the G-treatment, however, during these Stage I periods. These findings provide support for Hypothesis2(c) and mixed support for Hypothesis2(b).

As in the Stage I A-treatment, average permit prices in the Stage II allocation auction also range widely, with a mean of 114.2 (median 112). This mean rises over the first 3 periods. However, as expected, average prices are significantly lower in Stage II compared to the Stage I allocation auction (Wilcoxon signed-rank test p-value < 0.01). This is in line with Hypothesis 3(a), since cost-reduction opportunities in Stage II lead to lower equilibrium permit prices. In addition to the allocation auction in the A-treatment, similar reasoning applies to the permit prices in the double auction market in both the G-treatment as well as A-treatment: because of the MAC reductions realized through R&D investment, average prices are also significantly lower in Stage II than in Stage I (Wilcoxon signed-rank test p-value < 0.01 in both the auctioning and grandfathering cases).

Following the R&D investment choice in Stage II, a stochastically determined number of firms of each type successfully innovate and lower their MAC. Denote the number of firms of type \( k = H,L \) innovating as \( N_{k} \in \left\{ {0,1,2,3,4} \right\} \). The equilibrium permit prices and the number of trades required for each firm to reach the efficient permit distribution depends on \( N_{L} \) and \( N_{H} \). As more firms innovate, equilibrium permit prices decline. As we noted in Sect. 4.1, based on the equilibrium R&D investment level of 30 for each firm type, each firm would successfully lower its MAC with probability 0.375. The independent innovation realizations for the 8 firms implies a specific probability distribution of the numbers of lower-cost abaters for each type, and associated with each of these realizations is a post-reconciliation trading range of competitive equilibrium prices. Since the allocation auction occurs before the R&D investments are undertaken, the expected equilibrium price range is relevant for the auction. This range is 119–122. However, our findings related to R&D investment show that actual investment levels usually exceed the predicted level of 30 (see Sect. 4.1). This subsequently leads to equilibrium price predictions that are below 119. In particular, based on the realized investment outcomes, average equilibrium prices in our experiment range between 115 and 118.

Since equilibrium prices depend on \( N_{L} \) and \( N_{H} \), our analysis compares the deviations of actual to equilibrium prices. As shown in Fig. 8, in the G-treatment prices start above the equilibrium range and then trend downward, but in all periods they exceed the equilibrium (on average). Due to substantial variation across sessions, however, prices are not significantly different from the equilibrium range (Wilcoxon signed-rank test p-value 0.203). As in Stage I, prices start lower in the A-treatment, but they quickly rise to levels similar to the G-treatment on average. These Stage II price deviations from the equilibrium are not significantly different across the A- and G-treatments. Unlike the G-treatment, however, these average prices in the A-treatment are significantly different from equilibrium (Wilcoxon signed-rank test p-value 0.013). This leads us to the following result:

Result 3

-

(i)

Permit prices are significantly lower in Stage II than in Stage I in both the G-treatment and A-treatment. This is consistent with Hypothesis3(a).

-

(ii)

The average Stage II allocation auction prices vary from 103 to 134 in the A-treatment, and are not significantly different from the expected equilibrium range of 119–122. This supports Hypothesis3(b).

-

(iii)

Double auction permit prices are on average higher than the equilibrium levels in Stage II in both the G-treatment and A-treatment, though they are only significantly different from equilibrium in the A-treatment. Thus, Hypothesis3(c) receives mixed support.

4.2 Permit Transaction Volume

In the Stage I allocation auction of the A-treatment the average number of permits purchased by type H firms is 5.42 per period and for type L firms 2.58 per period. Trends in these averages are not systematic across periods and the averages are significantly different across L-type and H-type firms (Wilcoxon signed-rank test p value < 0.01). A similar result holds for Stage II in the A-treatment where the average number of permits purchased by type H firms is 5.10 per period and for type L firms 2.90 per period. The type H average tends to decline and the type L average tends to increase across periods. These averages are significantly different across types (Wilcoxon signed-rank test p value < 0.01). This leads to the following result:

Result 4

H-type firms buy more permits than L-type firms in the allocation auction both in Stage I and Stage II. This is consistent with Hypothesis4.

The net transaction volume compares the permit holdings for individual traders of a particular type (H or L) at the start of double auction trading to the end of double auction trading in a Stage. It therefore washes out buying and selling of the same permits by the same individual trader within a period for speculative purposes. The predicted lower transaction volume in the A-treatment reconciliation trading is due to type L firms acquiring more permits in the allocation auction, so less trading is needed to reach efficient outcomes relative to the G-treatment.

The average net transaction volume in Stage I of the G-treatment is 3.16 per trader, which is significantly below the 5-unit volume needed to reach a fully efficient allocation of abatement responsibility (the average volume does tend to rise over time, however). This is inconsistent with Hypothesis 5(a). The average net transaction volume is only 0.40 per trader in Stage I of the A-treatment, which is significantly below the G-treatment average (Mann–Whitney rank-sum test p-value < 0.01). This is consistent with Hypothesis 5(b).

The amount of net transaction volume required to approach the efficient distribution of permits also depends on \( N_{L} \) and \( N_{H} \). As in Stage I, the net transaction volume in Stage II is much larger in the G-treatment (3.41 per trader) than in the A-treatment (0.62 per trader) (Mann–Whitney rank-sum test p-value < 0.01), hence also providing support for Hypothesis 5(b). As noted above, this is also expected in the allocation auction where type H firms acquire more permits than type L firms, implying that less trading is required in order to reach efficient outcomes relative to the G-treatment.

In the A-treatment, the double auction reconciliation market also plays an extra role in Stage II compared to Stage I. In theory, reconciliation trading is unnecessary in Stage I since no new information emerges after the allocation auction. The allocation auction could efficiently allocate the permits to the highest-cost marginal abatement units, so no additional trade is necessary. By contrast, in Stage II the cost innovations following R&D investment are realized after the allocation auction but before the reconciliation trading. We therefore expect greater net transaction volume in Stage II compared to Stage I. The experimental data show that the net volume increases from Stage I to Stage II in 7 of the 10 sessions, and overall this increase is statistically significant (one-tailed Wilcoxon signed-rank test p-value 0.046). This is consistent with Hypothesis 5(c).

The conclusions regarding transaction volume can be summarized as follows:

Result 5

-

(i)

Net transaction volume is (significantly) too low in the G-treatment in Stage I. This contradicts Hypothesis5(a).

-

(ii)

Net transaction volume is significantly lower in the A-treatment compared to the G-treatment both in Stage I and Stage II. This is consistent with Hypothesis5(b).

-

(iii)

Net transaction volume is significantly greater in Stage II than in Stage I in the A-treatment. This supports Hypothesis5(c).

5 Conclusions

A fundamental challenge confronting policy-makers in designing effective tradable permit markets concerns the incentives it creates for firms to invest in the development of advanced pollution control technologies. Using laboratory experiments, this study evaluates how the permit allocation mechanism affects firms’ incentives to invest in research and development (R&D), which could potentially lead to cost-reducing innovations. As in the field, allowing for R&D investment uncertainty is a natural ingredient in firms’ decision-making process. Incorporating R&D uncertainty is one of the novelties of our experimental approach, which can yield new insights into design features of tradable permit markets that are conducive to enhancing dynamic efficiency. To assess the dynamic efficiency performance of our experimental permit market, we take the allocation mechanism as the main treatment variable, where the treatments follow a permit allocation rule based on grandfathering or auctioning. This has some clear relevance for currently existing permit markets given the transition away from grandfathering allowances to increase the amount of permits to be auctioned, as is currently being implemented in Europe under the EU ETS for carbon emissions.

The key result of our study is that overall higher levels of R&D investments are observed in both the grandfathering and auctioning treatments relative to the efficient investment levels, and this over-investment is more prevalent under auctioning. Measuring dynamic efficiency as the actual level of R&D investment induced under the two allocation rules, auctioning appears to be dynamically more efficient than grandfathering.

Looking at permit price discovery in the pre- and post R&D investment stages, we find that average permit prices under auctioning tend to be below predicted equilibrium prices before investment. However, transaction prices in the pre-investment stage are not statistically different between auctioning and grandfathering. Further, as expected, R&D investments tend to put downward pressure on permit prices, as reflected by significantly lower price levels in the post-investment stage compared to the price levels before investment. This result holds for both grandfathering and auctioning.

In terms of market liquidity, our results show that permit transaction volume is significantly lower under auctioning relative to grandfathering. This is also as expected, since under auctioning the allocation of permits in the auction is driven by the firms’ marginal valuation of emissions (and abatement), which guides the bidding for permits. Since the firms’ marginal valuation of emissions is typically unknown under a grandfathering rule at the time of the actual permit allocation, more adjustment of permit holdings is required under grandfathering in the reconciliation market. Finally, the results confirm that stochastic R&D investment implies more adjustment of permit holdings and a higher transaction volume in the permit market post R&D investments.

Notes

In a model of technology adoption and diffusion but without (uncertain) R&D investment, Requate and Unold (2001, 2003) show that the emissions payment effect is non-existent in case of a single (small) firm without market power who cannot affect the permit price by adopting the new, lower-cost abatement technology.

Note that first-order condition (5b) shows that the permit price is contingent on a firm’s investment in R&D. This condition implies that, strictly speaking, a firm is not a price-taker. A firm being a price taker in the permit market implies that one (small) firm cannot manipulate the permit price; however, in aggregate the equilibrium permit price decreases if a sufficient number of firms are successful in R&D investment.

Risk neutrality is a common assumption in the industrial organization literature when modelling firm choices. In the experiment, however, the decision-makers are individuals who could be risk averse. It is straightforward to solve the first-order conditions under the assumption that firms are risk averse, such as for a commonly used CRRA utility function \( U =\Pi ^{1 - \gamma } \), with \( \gamma \) reflecting the constant relative risk parameter. However, our numerical calculations indicate that optimal equilibrium R&D investments for the parameter choices in the experiment are largely insensitive to the degree of risk aversion. We therefore only consider risk neutral firms in order to keep the model as simple as possible.

Parameter \( \beta \) reflects how effective (or efficient) firms are in their R&D process. For instance, it may represent a firm’s absorptive capacity to assimilate knew knowledge into its production process. In order to keep the analysis transparent, in the experiment we assume that this parameter is homogenous across firms.

Using conventional terminology, we refer to “double auction” as the auction where permits are traded throughout a continuous time interval, which is different from the aforementioned sealed bid allocation auction.

See http://ec.europa.eu/clima/policies/ets/ (accessed 31 January 2017).

Following Montgomery (1972) and Fischer et al. (2003), and most related papers in this literature, we assume firms are competitive in the permit market, and that no individual trader has market power over price. While it might not be accurate for some highly localized markets, such as for emissions to a small body of water with few polluting firms, it is more appropriate for large markets such as those for greenhouse gas emissions in Europe and in large regions of the U.S. This is also a good approximation for the continuous double auction markets used in our experiment for permit trading. A wide range of market experiments dating to Smith (1962) showed highly competitive and informationally efficient markets when trading was organized by such auction rules, even with relatively small numbers of traders; see Smith (1982) for an early survey. Prices in double auction markets are accurately characterized by the competitive equilibrium.

See Appendix A.2 for a detailed description of the procedure to numerically calculate this (quasi-symmetric) Nash equilibrium in R&D investment.

Based on the final 6 periods only, this treatment difference is only marginally significant (MW p-value = 0.089).

Column (3) replaces the H-type dummy variable with the Stage I permit expenditures. This measure is highly correlated with the trader type, since H-type traders much incur greater permit expenditures due to their high abatement costs.

The amount of unregulated emissions is 80, so with 32 permits available the firms have to abate by 80–32 = 48 units.

References

Agranov M, Fréchette G, Palfrey T, Vespa E (2016) Static and dynamic underinvestment: an experimental investigation. J Public Econ 143:125–141

Anderson T, Arnason R, Libecap GD (2011) Efficiency advantages of grandfathering in rights-based fisheries management. Ann Rev Resour Econ 3:159–179

Ben-David S, Brookshire D, Burness S, McKee M, Schmidt C (1999) Heterogeneity, irreversible production choices, and efficiency in emission permit markets. J Environ Econ Manag 38:176–194

Ben-David S, Brookshire D, Burness S, McKee M, Schmidt C (2000) Attitudes toward risk and compliance in emission permit markets. Land Econ 76:590–600

Botelho A, Fernandes E, Pinto LC (2011) An experimental analysis of grandfathering versus dynamic auctioning in the EU ETS. In: Isaac RM, Norton DA (eds) Research in experimental economics, vol 14. Emerald Group Publishing, Bingley, pp 37–76

Camacho-Cuena E, Requate T, Waichman I (2011) Investment incentives under emission trading: an experimental study. Environ Resour Econ 53:229–249

Cason TN, Raymond L (2011) Framing effects in an emissions trading experiment with voluntary compliance. In: Isaac RM, Norton DA (eds) Research in experimental economics, vol 14. Emerald Group Publishing, Bingley, pp 77–114

Cramton P, Kerr S (2002) Tradeable carbon permit auctions: how and why to auction not grandfather. Energy Policy 30:333–345

Fischbacher U (2007) z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10:171–178

Fischer C, Parry IWH, Pizer WA (2003) Instrument choice for environmental protection when technological innovation is endogenous. J Environ Econ Manag 45:523–545

Gangadharan L, Croson R, Farrell A (2013) Investment decisions and emissions reductions: results from experiments in emissions trading. In: List J, Price M (eds) Handbook on experimental economics and the environment. Edward Elgar Publishing Ltd, Cheltenham, pp 233–264

Goeree JK, Palmer K, Holt CA, Shobe W, Burtraw D (2010) An experimental study of auctions versus grandfathering to assign pollution permits. J Eur Econ Assoc 8:514–525

Goeree JK, Holt CA, Palfrey TR (2016) Quantal response equilibrium: a stochastic theory of games. Princeton University Press, Princeton

Grimm V, Ilieva L (2013) An experiment on emissions trading: the effect of different allocation mechanisms. J Regul Econ 44:308–338

Kneese AV, Schultze CL (1975) Pollution, prices and public policy. Brookings Institute, Washington

Lind B, Plott CR (1991) The winner’s curse: experiments with buyers and sellers. Am Econ Rev 81:335–346

Lyon RM (1982) Auctions and alternative procedures for allocating pollution rights. Land Econ 58:16–32

Montero J-P (2002) Permits, standards, and technology innovation. J Environ Econ Manag 44:23–44

Montgomery WD (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 5:395–418

Popp D (2005) Lessons from patents: using patents to measure technological change in environmental models. Ecol Econ 54:209–226

Qiu L (1997) On the dynamic efficiency of Bertrand and Cournot equilibria. J Econ Theory 75:213–229

Requate T (2005) Dynamic incentives by environmental policy instruments—a survey. Ecol Econ 54:175–195

Requate T, Unold W (2001) On the incentives created by policy instruments to adopt advanced abatement technology if firms are asymmetric. J Inst Theor Econ 157:536–554

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up? Eur Econ Rev 47:125–146

Smith VL (1962) An experimental study of competitive market behavior. J Polit Econ 70:111–137

Smith VL (1982) Microeconomic systems as an experimental science. Am Econ Rev 72:923–955

Suter JF, Spraggon JM, Poe GL (2013) Thin and lumpy: an experimental investigation of water quality trading. Water Resour Econ 1:36–60

Taschini L, Chesney M, Wang M (2014) Experimental comparison between markets on dynamic permit trading and investment in irreversible abatement with and without non-regulated companies. J Regul Econ 46:23–50

Taylor MR (2012) Innovation under cap-and-trade programs. Proc Natl Acad Sci 109:4804–4809

Weber TA, Neuhoff K (2010) Carbon markets and technological innovation. J Environ Econ Manag 60:115–132

Wråke M, Myers E, Burtraw D, Mandell S, Holt C (2010) Opportunity cost for free allocation of emissions permits: an experimental analysis. Environ Resour Econ 46:331–336

Zhao J (2003) Irreversible abatement investment under cost uncertainties: tradable emission permits and emission charges. J Public Econ 87:2765–2789

Funding

Funding was provided by U.S. Environmental Protection Agency (Grand No. R833672), European Investment Bank (Grand No. EIB-University Research Action Programme).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 A.1 Derivation First-Order Conditions (5a) and (5b)

Using Eq. (4) and writing \( F\left( {q_{i} ,x_{i} } \right) = {\mathbb{E}}U\left[ {\Pi _{i} \left( {q_{i} ,x_{i} } \right)} \right] \), with

partial differentiation w.r.t. \( q_{i} \) directly yields (5a):

Partially differentiating w.r.t. \( x_{i} \) gives:

□

1.2 A.2 Numerical Calculation of Nash Equilibrium in R&D Investments

This Appendix provides additional details for the numerical calculation of the quasi-symmetric Nash equilibrium in R&D investment, summarized in Sect. 3.1. All H-type firms share the same abatement cost schedule, and all L-type firms share another abatement cost schedule. Moreover, all firms have the same costs of R&D, \( C(x_{i} ) \), and the same innovation success function \( h(x_{i} ) \). Therefore, all firms of the same type share the same best-response function. This makes the quasi-symmetric equilibrium, where all firms of the same type choose the same equilibrium investment level, most logical to consider.

To calculate the type-specific best response functions, we first need to calculate the competitive equilibrium prices for every possible combination of innovation success. Given our parameters with 8 firms, divided into 2 types, and a binary (success/failure) outcome for each firm, 25 distinct outcomes for innovation success are possible. Figure 9 illustrates 3 of these 25 alternatives. The highest, solid line indicates an outcome with no R&D success. This is the original, aggregate pre-R&D marginal abatement cost schedule illustrated in Fig. 1 of the main text, with equilibrium prices in the range [135, 138] as shown in the small horizontal lines where this curve crosses the required abatement quantity of 48.Footnote 11 The middle, dashed line corresponds to an outcome in which two H-type firms and one L-type firm successfully innovate. This lowers the aggregate marginal abatement cost schedule, so that it intersects the aggregate permit supply at a competitive equilibrium price of 118. The lowest, dotted line illustrates to an outcome in which three H-type and two L-type firms successfully innovate. Competitive equilibrium prices in this case fall to 105, since the greater R&D success leads to lower abatement costs and thus lower permit prices.

We similarly calculate the competitive equilibrium permit prices for all 25 combinations of potential innovation success across the 8 firms. For each of these 25 equilibrium prices, it is straightforward to calculate the profits for four different types of firms: (1) H-type innovator; (2) H-type non-innovator; (3) L-type innovator; and (4) L-type non-innovator.

Our goal is to calculate the Nash equilibrium R&D investment levels for the eight firms. The firms make their investment decisions simultaneously, and we make the rational expectations assumption that they condition price beliefs on competitive equilibrium behavior for the (25 different) double-auction permit market outcomes depending on innovation success. Every combination of investment levels leads to a specific, 25-element probability distribution over the likelihood of the 25 R&D outcomes. For example, if all eight firms invest \( x_{i} = 0 \) in R&D the outcome of zero R&D success occurs with probability one. This is not a Nash equilibrium, however, because firms of either type could best respond with an investment choice of \( x_{i} > 0 \) and increase expected payoffs. If four firms invest 20 and four firms invest 30, to take another example, then the outcome of zero R&D success occurs with probability 0.0397, and the middle outcome illustrated in Fig. 9 with a price of 118 occurs with probability 0.0915. These probabilities follow from the innovation success function \( h(x_{i} ) \) and all possible combinations of binary success outcomes.

Accounting for these equilibrium prices for every possible innovation outcome, it is straightforward to calculate the expected profits at each outcome for each type of firm (and for the innovators and non-innovators). For example, in the case with 3 R&D success and an equilibrium price of 118 considered above, given her new lower abatement costs an H-type innovator buys only two permits rather than the five permits purchased pre-innovation. She also pays the lower price of 118 per permit. These changes raise equilibrium permit market profits from 766 pre-innovation to 1061 post-innovation. This increase needs to be weighed against the cost of R&D investment, \( C(x_{i} ) \).

Finally, using the probability of each innovation outcome generated by any combination of R&D investment, we can calculate the best response R&D investment to any combination of investment levels of the other seven firms. For a Nash equilibrium we need to find the mutual best response, where no firm can improve profits by choosing a different R&D investment level given the investment levels of others. It turns out that this Nash equilibrium investment level is identical for the two firm types, \( x_{H}^{*} = x_{L}^{*} = 30 \), as stated in the main text. By deviating to a higher or lower investment level, firms of either type would reduce their expected profit.

1.3 A.3 Experiment Instructions

1.3.1 General

This is an experiment in the economics of decision making. The instructions are simple and if you follow them carefully and make good decisions you will earn money that will be paid to you privately in cash. All earnings on your computer screens are in Experimental Dollars. These Experimental Dollars will be converted to real Dollars at the end of the experiment, at a rate of 800 Experimental Dollars = 1 real Dollar. Notice that the more Experimental Dollars you earn, the more cash that you receive at the end of the experiment. Everyone will also receive a fixed participation payment of $5 that will be added to this total.

We are going to conduct a number of periods, each divided into two stages. At your seat you will find a sheet labeled Personal Record Sheet, which will help you keep track of how your decisions impact your earnings. You are not to reveal this information to anyone. It is your own private information.

In each period and stage you will produce units of a good. For every unit of the good that you produce, you will incur a production cost which will take away from your earnings. In order to avoid these costs, you may wish to purchase “coupons.” Each coupon allows you to produce 1 less unit of the good.

At the beginning of each period and stage you will receive cash in the form of a Fixed Period Revenue. There will then be an opportunity for you to buy coupons in an auction and then a time for you to sell or purchase coupons to and from other participants. At the end of each period you will pay your production costs. Your earnings each period are determined as follows:

Your Fixed Period Revenue does not depend on any actions you take, and does not change throughout the experiment. (In fact, it is already written on your Personal Record Sheet.) You will receive this revenue at the beginning of each period and stage so that you have cash available with which to trade.

1.3.2 Production Costs

You must pay production costs when you produce units. The cost of each unit produced is typically different from the cost of other units produced, and your costs may or may not be different from the costs of other participants. Your production costs are always shown on the left side of your computer screen, as illustrated in Fig. 10 (the numbers on this example screen are obscured, and you won’t actually learn your values until the experiment begins). Everyone can produce up to 10 units, and the cost of each unit is written separately.

For example, suppose your first unit produced costs 100, your second unit produced costs 200, and your third unit produced costs 300, etc. If these were your production costs and you produced 3 units, your total costs would be 100 + 200 + 300 = 600. So you must recognize that the costs shown on your screen are the extra costs associated with each additional unit produced.

1.3.3 Coupons

We’ve already explained that your Fixed Period Revenue never changes, but your costs increase when you increase production. So why should you ever produce any units? The reason comes from today’s rule:

This rule means that you can avoid production (and save on your production costs) by holding more coupons. Anyone can adjust their coupon holdings by buying and selling them in a market that will operate over the computer network. If you sell coupons your cash increases by the sale amount, and if you buy coupons your cash decreases by the sale amount. Later in these instructions we explain the rules for buying and selling coupons.

Why might you want to buy a coupon? Remember that coupons allow you to avoid production, and they are always applied to the most expensive production first. If you currently hold 7 coupons, for example, and if you had the example production costs in the example above, then the last unit that you must produce is the 3rd unit (because 10 − 7 = 3). The production cost of this 3rd unit is 300. So if you can buy a coupon for less than 300, this might be a good idea since it allows you to save the production cost of 300. For example, if you bought one additional coupon for 280, you save the production cost of 300 and therefore make a profit (because of the lower costs that you need to incur) of 300 − 280 = 20.

Why might you want to sell a coupon? Continuing the illustration based on the example above, suppose that you currently still hold 7 coupons and the cost of the last unit produced is still 300. If you had 1 less coupon, the cost of the next unit produced (the 4th unit) would be 400. If you can sell a coupon for more than 400, this might be a good idea since these sales revenues exceed the production costs of this 4th unit. For example, if you sell a coupon for 420, even if you incur the additional (4th unit) production cost of 400 you would still make a profit on this sale of 420 − 400 = 20.

1.3.4 Coupon Auction

At the beginning of each stage, we will conduct an auction over the computer to allocate 32 coupons to you and the 7 other participants in your group. You will enter bids for the coupons you might want to buy using a bidding screen like the one shown in Fig. 11. You can specify a different maximum price for every coupon you might want to purchase. After everyone has submitted their bid prices, these prices will be ordered from highest to lowest. The 32 highest bids will be allocated coupons, but they will all pay the same price–the lowest accepted price. Therefore, many successful bidders will pay a price that is lower than their indicated bid prices.

After this initial auction the results will be displayed, indicating the price that everyone paid for coupons, and shown to each individual will be the number of coupons purchased and the total amount spent on coupons in the auction (which is simply the price times the number bought). The remaining cash available for the remainder of the stage will also be updated.

1.3.5 Coupon Trading Stage: How to Trade Coupons with Other Participants

During the trading stage, coupons can be purchased from and sold to other participants. At any time during the trading stage, everyone is free to make an offer to buy a coupon at a price they choose; likewise, everyone is free to make an offer to sell a coupon at a price they choose. Everyone is also free to buy at the best offer price specified by someone wishing to sell, and everyone is free to sell at the best offer price specified by someone wishing to buy. (Of course, there are some limits: to sell a unit or make a sales offer, you need to have a coupon to sell. And to buy a unit or make a buy offer, you need to have enough cash to pay.)

You will enter offer prices and accept prices to execute transactions using your computer. Figure 10 shows the market trading screen for the coupon trading stage. The time left in the period is shown on the upper right of the trading screen. You will have 2 min to buy and/or sell coupons in each trading stage.

Buying coupons Participants wishing to buy can submit offer prices using the “Buy Offer” box in the right side of the screen, and then clicking on the “Make Offer” button in the lower right. This offer price is immediately displayed on all traders’ computers on the upper right part of the screen, labelled “Buy Offers.” Once this offer price has been submitted, anyone wishing to sell can accept this price offer. This results in an immediate trade at that price. The previous trading prices in the current period are displayed in the “Trading Prices” list in the center of your computer screen.

If there are already Buy Offers displayed in the current period, then new buy offers must provide better trading terms to the sellers. Sellers prefer higher prices, so any new buy offers must be higher than the current highest buy offer. Your computer will give you an error message if you try to offer a lower price than the best price currently available.

Another way to buy coupons is with the “Buy Coupon” button. Anyone wishing to buy can accept a sell offer price by highlighting it in the Sell Offers column and clicking the “Buy Coupon” button on the bottom of that column. This results in an immediate trade at that price.

Selling Coupons Participants wishing to sell can submit offer prices using the “Sell Offer” box on the left side of the screen, and then clicking on the “Make Offer” button below this box. This offer price is immediately displayed on all traders’ computers on the left part of the screen, labelled “Sell Offers.” Once this offer price has been submitted, anyone wishing to buy can accept this price offer.

If there are already Sell Offers displayed in the current period, then new sell offers must provide better trading terms to the buyers. Buyers prefer lower prices, so any new sell offers must be lower than the current lowest sell offer.

Another way to sell coupons is with the “Sell Coupon” button. Anyone wishing to sell can accept a buy offer price by highlighting it in the Buy Offers column and clicking the “Sell Coupon” button on the bottom of that column. This results in an immediate trade at that price.

Regardless of how you buy or sell coupons, your coupon and cash totals will be updated at the time of purchase or sale. You can always find these totals in the bottom left of the screen, along with your required production level based on your current level of coupons.

1.3.6 Period Structure

This experiment will consist of 12 paid periods, each divided into two stages of trading. Each period is identical and will include the following steps in Fig. 12.

1.3.7 Trading Stage 1

During each period, you will have two separate trading stages during which you may choose to buy and/or sell coupons, an “Initial Trading Stage” and a “Final Trading Stage,” each lasting 2 min. Note that an initial auction of coupons will take place before each of these 2 distinct trading stages.

1.3.8 Mid-Period Status and Investment Decision

Some fixed revenues will be distributed to participants at the beginning of both trading stages. (These revenue amounts are already on your record sheet.) The Mid-Period Status screen (Fig. 13) provides a summary of your coupon levels after trading stage 1, as well as your production costs and profit. You will enter this on your record sheet.

1.3.9 Mid-Period Investment Choice

In the mid-period break between Stage 1 and Stage 2 you will have an opportunity to invest to possibly reduce your Production Costs during Stage 2. Since you must pay the Production Costs for any coupon below 10 that you do not hold at the end of each stage, lower Production Costs can increase your profits. If your investment succeeds, each Production Cost for each unit is reduced by exactly 50 Experimental Dollars.

You can increase your likelihood of having lower Production Costs by choosing a greater investment. In particular, the table below shows how the chances of lowering your costs depends on your investment choice. For example, if you choose option 5 and invest 64, then this means that you have a 44% chance of having lower costs in Stage 2. This means that out of 100 possible outcomes, on average 44 times your result would be lower costs.

You will learn whether your investment was successful in lowering your costs before you begin Trading Stage 2, in a screen such as the one shown below. If you were successful in lowering your Production Costs, the new lower costs will be displayed on your trading screen for Trading Stage 2.

1.3.10 Period Results

Once trading has been completed for Stage 2, the results of the stage will display on the screen. The information is similar to the Fig. 13 results screen shown above, except that the Investment Cost you paid will also be shown. You should copy this information onto your Personal Record Sheet at the end of each period, and then click “continue” to begin the next period. At the start of Stage 1 trading for the next period, everyone’s costs will begin again at the original, higher level.

1.3.11 Summary

-

1.

Your production costs shown on the left of your computer screen are the extra, additional costs incurred for each unit that you produce.

-

2.

There will be 2 trading stages. At the end of each stage your coupons held will determine the production costs you incur, since your units produced = 10 − coupons.

-

3.

Some fixed revenues will be distributed to participants at the beginning of both trading stages. No coupons will be carried over from stage 1 to stage 2.

-

4.

Before each trading stage, coupons can be purchased in an auction. The highest 32 bids will receive coupons, but they will all pay the amount in the 32nd highest (last successful) bid.

-

5.

Your current cash and coupon holdings, as well as the corresponding production level, are always provided during trading on the bottom left of your computer screen.

-

6.

Your coupon receipts and changes in coupon levels, initial production level, and stage 1 profits will be provided during the Mid-Period Results stage in between the 2 trading stages.

-

7.

You may be able to cut your Production Costs by 50 per unit for stage 2 by paying some investment cost. While you cannot guarantee lower costs, you can increase the chances of lower costs by choosing greater investment.

-

8.

Your coupon holdings, final production level, and total period profits will be provided during the Period Results stage at the end of each period. No coupons or cash will be carried over into the next period for use in trading.

-

9.

At the start of Stage 1 trading for the next period, everyone’s costs will begin again at the original, higher level.

If you have any questions during the experiment, please raise your hand and I will come to your seat. Are there any questions now before we begin the experiment?

Rights and permissions