Abstract

We analyse the international dimension of the EU Emissions Trading System (EU ETS) over the past two decades and in the foreseeable future by reviewing facts and economic theory. The facts mainly concern the international climate change regime and the EU’s relevant experience in international cooperation. Club theory shows how incentives can be created for cooperation on climate mitigation. The linkage of the EU ETS to the Kyoto flexible mechanisms had mixed results: it promoted emissions trading abroad, but the inflow of credits into the EU ETS added to a large market surplus and the environmental integrity of certain credits was problematic. Looking ahead, the ability of the EU ETS to reduce foreign emissions may grow. Key will be whether competitiveness and distributional effects are successfully addressed. The Carbon Border Adjustment Mechanism might help the EU reduce the risk of carbon leakage while incentivising emission reductions in countries exporting to the EU. The EU’s focus on reducing domestic emissions only, suggests we will probably not see new international linkages this decade. However, it cannot be excluded that the EU will revisit its decision and relax the domestic constraint.

Similar content being viewed by others

1 Introduction

In operation since 2005, the EU Emissions Trading System (EU ETS) is the oldest ETS for domestic climate change mitigation. More specifically, the EU ETS is a cap-and-trade system: it imposes a cap on total emissions of carbon dioxide, nitrous oxide, and perfluorocarbons from about 10,000 heavy energy-using and electricity-generating installations and aircrafts, covering around 40% of the EU’s greenhouse gas (GHG) emissions. Simply described, the cap of an ETS is given by the supply of emission allowances, whereas the demand for allowances depends on the levels of output and emission intensity of regulated entities, among other factors. The interplay of the demand and supply of emission allowances determines the price of the allowances, i.e. the carbon price. The cap, and with it the emissions, decline over time. In the EU ETS, assuming that the cap will be adjusted to the EU’s new level of climate ambition under the European Green Deal, the cap itself will reach in 2030 a level 61% below that of 2005 emissions (European Commission 2021a).

While being the second-largest ETS in the world, after China’s national ETS, the EU ETS currently covers less than 5% of global GHG emissions.Footnote 1 It follows that the significance of any impact of the EU ETS on global emissions will also depend on the extent of additional emission reductions that the EU ETS may be able to induce outside the EU. Indeed, since its early days, the EU ETS has not only been the cornerstone of EU domestic climate policy, but it has also played a role at the international level. Notably, the EU ETS has been a building block of the international carbon market and a reference for other jurisdictions with similar policies in place or under consideration. This wider role of the EU ETS has served well the EU’s ambition to be a leader in the fight against climate change. It also points to an international dimension of the EU ETS that, so far, has been neglected in the literature.

Without a definition or explanation, the international dimension of an ETS is a blurred concept. In the absence of relevant references in the literature, the way we think of it is in terms of the effects that an ETS can induce abroad and, similarly, the effects that an ETS can transmit from abroad to the domestic economy. We thus propose the following tentative definition: The international dimension of an ETS concerns its ability to induce environmental, economic, institutional or technological effects outside its national jurisdiction, whether via a policy linkage or not. It also concerns the sensitivity of an ETS to analogous effects of foreign or international climate policies on the domestic economy. Firstly, this definition considers different types of international spillovers that may come about through an ETS. Along with emission reductions and other potential environmental effects, economic as well as institutional and technological effects are contemplated. Secondly, the definition hints at different channels through which an ETS may induce or transmit these effects. International linkages with other carbon markets are one avenue. Following Mehling et al. (2018a), a linkage between two or more climate mitigation policies can either be ‘hard’ or ‘soft’. A hard linkage implies that mitigation results achieved in a jurisdiction can be traded, in the form of allowances or credits, and used for compliance in another. A soft linkage only implies that explicit or implicit carbon prices in different jurisdictions tend to move together.Footnote 2 Even without a linkage, an ETS could be the source or the receiver of international spillovers. For example, an ETS could become a policy model, so that its design or implementation may inspire regulatory changes in other existing ETSs or spur the adoption of new ETSs or other climate policies abroad (Wettestad and Gulbrandsen, 2018).

In the present paper, we analyse the international dimension of the EU ETS, primarily with a view to anticipating how this carbon market may be able to induce emission reductions abroad. The motivation for our investigation is related to some major recent developments in climate policy, both internationally and at the EU level. At the international level, a new climate change regime has emerged. The Paris Agreement, without directly addressing the free-rider problem, relies on voluntary efforts and a ratchet mechanism to drastically reduce global GHG emissions and ultimately stabilize Earth’s climate. Within this framework, ‘climate clubs’ can play an important role. Climate clubs are cooperative models conceived for increasing climate ambition, and carbon markets like the EU ETS can be an integral part of them. At the EU level, the European Green Deal has both widened the scope and raised the ambition of EU climate action: a leap enshrined in the climate neutrality target (or ‘net-zero emissions’) by 2050 (European Parliament and Council, 2021). Innovative policy tools will be used, such as the Carbon Border Adjustment Mechanism (CBAM) proposed by the European Commission (European Commission, 2021b), among others. The main purpose of the CBAM is to reduce the risk of carbon leakage (i.e. the displacement of GHG emissions caused by different levels of climate policy stringency), but the CBAM is more than an add-on to the EU ETS: it is potentially also a means to creating climate clubs.

Our analysis brings together facts and economic theory to understand how the international dimension of the EU ETS has evolved over time and how it may evolve in the future. The facts considered concern the changes in the international climate change regime, from the Kyoto Protocol to the first six years of the Paris Agreement era, and the experience of the EU in international carbon market cooperation. This includes the linkage of the EU ETS to the Kyoto flexible mechanisms, namely the Clean Development Mechanism and Joint Implementation, the linkages of the EU ETS with other ETSs, as well as other relevant initiatives. The opportunities and in a sense even the motives for linking, aligning, or simply promoting carbon markets and other climate policies, have evolved in connection with the international climate change regime. As regards the theory recalled for our analysis, we focus on clubs. This niche of economic theory help us imagine how domestic climate policies, especially ETSs, may be leveraged to reduce global emissions more rapidly.

The rest of the paper is organised as follows. Section 2 recalls the evolution of the international climate change regime. Section 3 reviews the experience of the EU with international cooperation related to the EU ETS. Section 4 illustrates the club approach to climate cooperation. Section 5 discusses how the EU ETS may induce emission reductions abroad. Section 6 concludes.

2 The International Climate Change Regime: From Kyoto to Paris

Knowing the context in which an ETS operates, most notably the configuration of the international climate change regime, is essential for understanding the international dimension of that ETS. The EU ETS was established in connection with the Kyoto Protocol. Then, after a phase of uncertainty about the future international climate change regime, the EU ETS entered the Paris Agreement’s era.Footnote 3

2.1 The Kyoto Protocol’s Regime and the Gestation of Its Successor

Adopted in December 1997 and in force since February 2005, the Kyoto Protocol to the United Nations Framework Convention on Climate Change (UNFCCC) has been the first international agreement imposing binding targets for GHG emissions. Under the Kyoto Protocol, 37 industrialised countries and the EU committed to reducing their emissions by an average of 5% against 1990 levels, over the period 2008–2012. Each country had its own emissions target (EU: − 8%; Japan: − 6%: Australia: + 8%; etc.Footnote 4), which – crucially – had been set through a negotiation process rather than being unilaterally determined. The characterisation of the Kyoto Protocol as a top-down regime mainly relates to this negotiation, whereby the exact distribution of efforts was agreed from the outset.

The Kyoto Protocol gave countries a certain degree of flexibility in meeting their climate mitigation commitments through three market-based mechanisms: International Emissions Trading (IET), the Clean Development Mechanism (CDM), and Joint Implementation (JI). Cost-effectiveness was the economic principle underpinning the three mechanisms, which shared the rationale ‘cut emissions where is cheapest’. For countries with emission targets, the so-called Annex-B countries, IET allowed exchanges of Assigned Amount Units (AAUs) made available by those overshooting their targets.Footnote 5 The CDM and JI, by contrast, generated emission credits on a project basis, i.e. against individual projects that proved to have reduced emissions. The CDM involved investment in sustainable development projects that reduced emissions in developing countries, whereas JI involved analogous projects in developed countries, typically transition economies. Together with AAUs and Removal Units (RMUs) generated by emission removal projects in the land use, land-use change and forestry sector, the CDM and JI credits, called Certified Emission Reductions (CERs) and Emission Reduction Units (ERUs), respectively, were the tradable Kyoto units.

While resting on strong legal and economic foundations, the Kyoto Protocol had a major limitation in the modest share of global emissions that was subject to reduction targets.Footnote 6 This is why, ever since the Kyoto Protocol’s entry into force, the main question facing the UN climate change regime was what to do after 2012, i.e. after the Kyoto emission targets expire. The EU favoured a new Kyoto-type regime, this time inclusive of emission targets also for developing countries. However, support for this solution from other countries was not sufficient (Bäckstrand and Elgström, 2013). In hindsight, the 15th UNFCCC Conference of the Parties (COP15), held in Copenhagen (Denmark) in December 2009, was both a low and a turning point in international climate change negotiations. The wished outcome of the conference was a new legal agreement addressing the post-2012 period. Such an agreement, however, did not materialise. Instead, COP15 produced a short, wide-ranging political agreement. Crucially, the Copenhagen Accord started a bottom-up process that allowed each participating country to define its own commitments and actions unilaterally (Bodansky, 2011).

After COP15, international negotiations moved steadily toward the creation of a climate change regime informed by the bottom-up approach. Building on the Copenhagen Accord, COP16, in Cancun (Mexico), was decisive in accelerating the process in that direction. At COP17, in Durban (South Africa), among other significant results was the decision to adopt by 2015 (COP21) a new agreement for the post-2020 period. The future agreement would include unilaterally-determined emissions targets for all countries. In the meantime, the Kyoto Protocol’s second commitment period (2013–2020) would act as a bridge to the post-2020 regime. However, the countries that took up new emission reduction targets for the period 2013–2020 represented together less than 15% of global emissions.Footnote 7

2.2 The Paris Agreement

Adopted in December 2015 and in force since November 2016, the Paris Agreement is the legal foundation of the international climate change regime post-2020. The Paris Agreement was signed by 195 countries, accounting for 99% of global GHG emissions.Footnote 8 The ultimate objective of the Paris Agreement is to hold the increase in the global average temperature to well below 2 °C above pre-industrial levels, “pursuing efforts to limit the temperature increase to 1.5 °C above pre-industrial levels”. Effectively, the Paris Agreement sets out a long-term framework for addressing the climate change problem in a definitive way.

The Paris Agreement radically differs from the Kyoto Protocol in several respects. First and foremost, the Paris Agreement obliges all countries to take action to limit global warming, thereby overcoming the main limitation of the Kyoto Protocol. Second, each country’s contribution to the collective effort of climate stabilisation is determined unilaterally. This aspect is emphasised by the term Nationally Determined Contributions (NDCs), which is how countries’ voluntary commitments, or formal pledges, are called. Therefore, countries did not have to agree ex-ante on a burden sharing, which would have been very difficult with a large number of participants. Third, the NDCs can be heterogeneous, meaning that they do not necessarily have to be specified in terms of emission reduction targets.Footnote 9 Fourth, the Paris Agreement is inherently dynamic, in that the achievement of the climate change mitigation objective rests on a ratchet mechanism whereby the NDCs are reviewed and increased at five-year intervals. Indeed, the initial NDCs taken together fell well short of the target (UNEP 2017). The Paris Agreement as a whole has been described as a hybrid approach blending bottom-up and top-down features (Chan et al. 2018). The first relate to the freedom of national governments in setting their NDCs. The second refer to the obligations that governments still have, such as monitoring and reporting duties among others.Footnote 10

The Paris Agreement can be considered the successful outcome of a process that originated from the diplomatic failure of the UNFCCC COP15.Footnote 11 Still, the regime established by the Paris Agreement tolerates significant uncertainty about its own effectiveness in addressing climate change. Both perspectives are arguably true, which would explain the range of views over the Paris Agreement: regarded by some as ‘Plan A’ (Sabel and Victor, 2016) and by others as an entirely inadequate framework for the reality of climate change (Spash, 2016).Footnote 12 The eventual success or failure of the Paris Agreement will depend on the realisation of a dynamic, multi-decade process. As Keohane and Oppenheimer (2016) put it, “the Paris Agreement is less an accomplishment than part of an ongoing process”. As such, monitoring the evolution of this process is particularly important.

2.3 Cooperative Approaches in the Paris Agreement (Article 6)

A central feature of the Paris Agreement, particularly relevant to this paper, is the possibility for countries to use so-called cooperative approaches in order to meet their NDCs and increase the level of climate ambition.Footnote 13 While they differ in some important ways, the Paris Agreement’s cooperative approaches are the direct descendants of the Kyoto Protocol’s flexible mechanisms.Footnote 14 Article 6 of the Paris Agreement describes them with a rather vague wording, which has left much space for interpretation in the past few years. Basic issues relating to the scope, governance, accounting, and infrastructure of the cooperative approaches have been the object of long negotiations (Asian Development Bank, 2018).Footnote 15 At the time of writing (January 2022), the UNFCCC COP26 has just been held in Glasgow (UK), and a major outcome of the summit was precisely the reaching of an agreement over the fundamental rules operationalising Article 6. The definition of these rules was a critical step in the development of the future international carbon market.Footnote 16

Article 6 of the Paris Agreement comprises four main parts.Footnote 17 First, Article 6.1 contains a general provision for international cooperation toward Parties’ (countries) NDCs. It is broad and meant to cover all specific cases of cooperation in Article 6, and others that may emerge in the future. Second, Articles 6.2 and 6.3 contain provisions for Parties to cooperate through ‘internationally transferred mitigation outcomes’ (ITMOs). These articles specify what Parties shall do to use ITMOs toward their NDCs. The intervention by the Conference of the Parties serving as the meeting of the Parties to the Paris Agreement (CMA), which oversees the implementation of the Paris Agreement, is limited to developing and providing guidance. The only mandated role for the CMA under 6.2 is to develop accounting standards that any Parties engaged in ITMOs would have to observe. In this respect, Parties are given a significant amount of freedom in what they can do.Footnote 18 Third, Articles 6.4–6.7 contain provisions which outline a multi-scope mechanism to produce emission reductions that can be used to fulfil the NDC of another Party and support sustainable development. In contrast to Article 6.2, this mechanism is designed under the authority and guidance of the CMA. The CMA has the role of setting standards in all aspects, including approval processes, technical aspects for quality and quantity of what is being transferred, and avoidance of double counting. Fourth, Articles 6.8 and 6.9 establish a framework for non-market cooperative approaches.

The two mechanisms proposed in Articles 6.2–6.3 and Articles 6.4–6.7 allow for international emissions trading. Article 6.2 provides a framework that allows for international linkages between ETSs or indeed between any market-based mechanisms,Footnote 19 but also one under which other more innovative ideas can be developed.Footnote 20 Article 6.4, provides a solid, more restrictive approach, which will serve to establish a new and improved version of the Kyoto’s CDM/JI (Marcu, 2016a, 2016c). As to Article 6.8, it is still unclear what this will exactly cover, but some focus, e.g. the coordination of different non-market cooperative approaches, has started to emerge (Asian Development Bank, 2018).Footnote 21

3 The EU ETS in the International Carbon Market

Both the configuration and the size of the international carbon market are closely related to the configuration and the state of the international climate change regime. With its flexible mechanisms (IET, CDM and JI), the Kyoto Protocol enabled the emergence of a substantial international carbon market. The fate of the same market, however, followed the anticlimax of the Kyoto Protocol’s regime. The outcome of the UNFCCC COP15, in 2009, certified the end of hopes for a new extended Kyoto-type regime post-2012, that is, one with legally binding emissions targets for all (or almost all) countries. Consequently, the international carbon market was first plagued by uncertainty over the future climate change regime. It then landed in the desolate territory of the Kyoto Protocol’s second commitment period (2013–2020). The Paris Agreement, thanks to its cooperative approaches and almost universal participation by the international community, revived the prospects for the future international carbon market. The EU can contribute to this probable renaissance, capitalising on some important experiences accumulated through the EU ETS.

3.1 Experience with the Kyoto Credits

Since its inception, the EU ETS was designed so as to be part of the nascent international carbon market and thus to contribute to its development. In concrete terms, the EU ETS was directly connected to the Kyoto system through the Linking Directive (European Parliament and Council 2004), whereby the owners of regulated installations could use international emission credits generated by the CDM and JI to meet part of their compliance obligations.Footnote 22 The main sources of demand for tradable emission units under the Kyoto Protocol were in fact the governments of Annex-B countries, i.e. those with emission reduction targets, and the owners of installations in the EU ETS. The former were issued AAUs and, at the end of the Kyoto Protocol’s first commitment period (2008–2012), had to surrender AAUs or CERs/ERUs equal to their economy-wide emissions. The latter were issued European Union Allowances (EUAs) and, every year, had to surrender EUAs or (within limits) CERs/ERUs in overall amounts that matched their annual emissions.Footnote 23

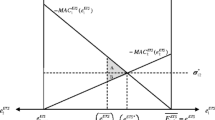

The importance of the EU ETS in terms of market volume and strength of demand for Kyoto units meant that the EUA price became the reference price of the international carbon market. Had there not been restrictions on the use of international credits in the EU ETS, CER/ERU prices would have converged to EUA prices. In reality, however, CER/ERU prices tended to be a few euros lower than EUA prices. The price discount reflected the risk that CERs/ERUs in the secondary market may not be usable for compliance in the EU ETS. This risk, in turn, was mainly related to uncertainty as to whether the limit for the use of international credits in the EU ETS would be reached (Fig. 1).Footnote 24

As of Phase II of the EU ETS (2008–2012), quantitative restrictions to the use of international emission credits as emission offsets were applied. Specifically, installation owners were allowed to use international credits up to a percentage of total allowances determined in the National Allocation Plans. These percentages ranged from 0% (Estonia) to 20.6% (Spain), summing to 13.4% for all Member States taken together (Ellerman et al., 2010). The possibility to use international credits was further tightened in Phase III (2013–2020), through both quantitative and qualitative restrictions.Footnote 25 To be sure, already low carbon prices in the EU ETS did not invite the European legislator to open up the market any further to inflows of emission credits, as this would have caused additional downward pressure on EUA prices.Footnote 26 At the same time, the use of CERs originated from projects involving HFC-23 gas destruction and nitrous oxide emissions from adipic acid production was banned, due to environmental integrity concerns (European Commission 2011). Finally, with the reform for Phase IV (20021–2030), the use of emission credits was ruled out altogether.

All in all, the linkage of the EU ETS to the Kyoto flexible mechanisms can be regarded as having produced some positive results but also criticalities for the European carbon market. On the one hand, the linkage delivered the result of extending the carbon price signal to countries and sectors not covered by the EU ETS, thus stimulating climate mitigation projects (see Tables 1 and 2).Footnote 27 This consideration is particularly relevant for projects undertaken in developing countries, as they implied technology transfer, capacity building and institutional familiarisation with carbon markets. In this sense, the CDM – and the EU ETS through it – played a role in the uptake of emissions trading in China (Fei Teng 2021).

On the other hand, the use of international credits in the EU ETS affected the system in two main ways. One relates to the dubious environmental integrity of CERs originated from certain projects (see, e.g., Cames et al. 2016a, b; Schneider and Kollmuss 2015; Zhang and Wang 2011), which warranted the intervention of the European Commission. The second regards the impact that the inflow of emission credits had on EUA prices, putting further downward pressure on already low price levels. In addition, the quantitative limits on the use of credits resulted in price differentials with the EUAs, which enabled substantial windfall profits (de Bruyn et al. 2016).

3.2 Linking with Other ETSs

Beyond the linkage to the Kyoto flexible mechanisms, other experiences have been relevant to the international dimension of the EU ETS so far. Notably: the incorporation of Norway, Iceland and Liechtenstein into the EU ETS; the processes of linking with other ETSs; and the participation of the European Commission in international cooperation programmes supporting the adoption and diffusion of emissions trading or carbon pricing more generally.

Since its establishment, the EU ETS has expanded in the coverage of countries as well as sectors and GHGs. In 2007, Bulgaria and Romania were incorporated into the EU ETS merely as a consequence of their becoming EU members. The following year, after extended negotiations, Norway, Iceland and Liechtenstein also joined the EU ETS. In this case, the three countries, which were not EU members, agreed to join the EU ETS by virtue of being partners of the EU in the European Economic Area. Norway had already its own national ETS, which had been in operation since 2005. Since the European Commission rejected Norway’s plan to link with the EU ETS, Norway’s ETS was fully integrated into the EU ETS. Full integration only required limited regulatory adjustments in the Norwegian ETS (its design was similar to that of the EU ETS) and, on the EU side, modest temporary concessions in the application of the EU ETS legislation (Ellerman et al., 2010).

In 2010, negotiations started between the EU and Switzerland to link the respective ETSs. The agreement on a bilateral linkage was signed in November 2017 and became operational on January 1, 2020. The linkage allows participants in the EU ETS to use allowances from the Swiss ETS for compliance, and vice versa. It is the first agreement of this kind for the EU and also the first between two Parties to the Paris Agreement on climate change. To align the designs of the two ETSs, the Swiss ETS was extended to cover emissions from the aviation sector, which were not subject to any comparable policy in Switzerland. Prices of allowances in the Swiss ETS and in the EU ETS converged as expected, thus resulting in reduced competitive distortions, as companies have level playing field and simplified business especially for multinationals (Betz 2017). Expected benefits for the Swiss ETS include lower cost of emission reductions, enhanced liquidity and price stability (Vöhringer, 2012; Fuessler et al. 2015). In return, the economic impacts on the EU ETS should be negligible given the large difference in size between the EU ETS and the Swiss ETS (Englert, 2015).Footnote 28

In 2012, the European Commission and the Australian government announced their intention to link the EU ETS and a forthcoming Australian ETS.Footnote 29 The first stage of the linkage was supposed to take place in July 2015: initially a unilateral linkage, whereby Australian regulated entities would have been able to use EUAs to meet up to 50% of their compliance obligations. The linkage was due to become bilateral three years later (i.e. in 2018), with EU regulated entities being then allowed to use Australian Emission Units to fulfil their liabilities. The proposed linkage, however, raised concerns related to allowance over-allocation and low prices in the EU ETS. In particular, while the unilateral linkage would have lowered compliance costs in Australia and helped the EU reduce the allowance surplus in the EU ETS, it would also have appeared to weaken the ambition of the Australian system and generated significant financial flows from Australia to the EU. In the end, following Australia’s 2013 national elections, the linking plan was abandoned, as the new Australian government decided to repeal the whole ETS legislation.

3.3 International Cooperation

The development of the international carbon market is a complex, lengthy process. Experience to date shows that linking ETSs already in operation can take several years. It also shows that ETS linkages can be vulnerable to political changes within the jurisdictions involved. To consider linking ETSs, however, well-functioning domestic ETSs are needed in the first place. Establishing a well-functioning ETS indeed requires a nontrivial institutional effort.

Against this backdrop, the European Commission has been active in supporting other countries in the development of their ETSs by sharing its experience with the EU ETS. For example, the European Commission is a founding member of the International Carbon Action Partnership (ICAP), which brings together countries and regions with mandatory ETSs or intending to adopt mandatory ETSs. The ICAP provides a forum for sharing experience and knowledge as well as training courses. The European Commission is also a contributing participant of the World Bank’s Partnership for Market Readiness, which provides grant financing and technical assistance for capacity building and piloting of market-based tools for GHG emissions reduction. Further, in 2017, the European Commission initiated the Florence Process. The Florence Process is a policy dialogue that brings together representatives of key jurisdictions with carbon markets in operation, including China, Canada, New Zealand, Switzerland, California and Quebec, to discuss issues of common interest (Borghesi et al., 2018).

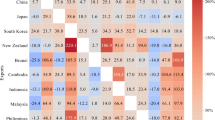

International cooperation is carried out on a bilateral basis too. The project ‘Platform for Policy Dialogue and Cooperation between EU and China on Emissions Trading’ is currently being implemented. It aims to provide capacity building and training to support Chinese authorities in their efforts to implement and further develop the Chinese national ETS. At the EU-China summit in 2018, the EU and China signed a Memorandum of Understanding to further enhance cooperation on emissions trading. The Memorandum has provided a reinforced basis for the policy dialogue, including through further forms of cooperation such as the joint organisation of seminars and workshops, joint research activities and ad-hoc working groups. Similarly, the European Commission has supported Korea through a project of technical assistance focused on building the capacity to implement Korea’s ETS, which was established in 2015. The success of Korea’s ETS is important as, together with China’s ETS, it could encourage the expansion of emissions trading in emerging economies and developing countries.

4 The Club Approach to Climate Cooperation

Climate change mitigation is one perfect example of a global public good, in that the resulting avoided damages of climate change are a non-rivalrous and non-excludable good throughout the world. The fundamental problem with public goods is the connected incentive that the agents involved have to free-ride on the efforts of the others; that is, not to contribute to the joint effort, or to contribute less than the social optimum requires (Ostrom, 2015). The difficulty of the international community to address climate change in an effective manner is rooted in this collective action problem. In direct response to it, the club approach to climate cooperation is the most popular conceptual framework for fostering international cooperation on climate action.

4.1 Climate Clubs

Club theory is a niche of economics whose origin is usually identified with a seminal study by Buchanan (1965). In general terms, a club can be characterised as a voluntary group whose members share a set of benefits, referred to as the ‘club good’, from which non-members are excluded. In the climate policy context, climate clubs are cooperative models of climate action for overcoming the limits imposed by free-riding behaviour on the part of one or more agents. Climate clubs are understood to be started by small groups of enthusiastic agents, i.e. countries, individuals, businesses, etc. willing to take action beyond their material self-interest, who would then try to entice other reluctant peers to join in (Victor 2011; Hovi et al. 2016).

The expediency of climate clubs is closely related to the reliance of the UNFCCC on the consensus rule. In many situations this rule dampens the ambition of climate action, as it suffices only one or few Parties to block collective decisions entailing appropriate efforts (i.e., of the scale required by climate science). The club strategy involves limited-membership regimes that produce or secure economic or other non-climate benefits accruing to participants in return for their stronger mitigation action or other climate-related action (e.g., adaptation, climate engineering or climate compensation). Examples of such benefits are, among others, access to R&D or financial programs (Carraro, 2016) and access to preferential trade arrangements (Nordhaus 2015). Moreover, both conditional commitments (pledges) from the club members and financial transfers within the club can be effective complements – additional to the club good(s) – for creating and subsequently enlarging climate clubs (Sprinz et al., 2018).

Though climate clubs in a strict sense, representing an alternative or a key complement to the UNFCCC, do not exist as yet, a broad understanding of the concept allows classifying different observed forms of climate cooperation under the same framework. In this regard, Stewart et al. (2017) distinguish between ‘classic clubs’, ‘pseudo clubs’, and ‘coalitions’. The classification is based on the relevance of the club benefits and the degree to which non-club members can be excluded from their fruition. While classic clubs provide clear and readily excludable benefits, pseudo clubs provide benefits that are more diffuse, less readily excludable, and potentially less easily quantifiable. An example are the reputational benefits of companies participating in carbon measurement and disclosure programmes.Footnote 30 Importantly, however, pseudo clubs without government regulation will not move from monitoring emissions to enforcing emission reductions (Green 2017). Climate coalitions are effectively further-diluted arrangements. They generally offer information or publicity-related benefits, while requiring limited or no real environmental commitments (Weischer et al., 2012; Andresen 2014).

4.2 Carbon Market Clubs

Using the taxonomy above, carbon market clubs are a type of classic climate club. Their specificity lies in emissions trading being the mandated approach for cooperatively pursuing the climate mitigation objective. Writing at a time when the idea of a bottom-up international climate change regime had only started to emerge, Ellerman (2010) suggested that the development of international carbon markets necessitates the provision of club benefits beyond those connected to market participation.Footnote 31 On the same question (commonly referred to in the literature as issue linkage), Keohane et al. (2017) present a more optimistic view, which is perhaps more consonant with the new context of the Paris Agreement and the related expectations. The authors envision the formation of a club of linked carbon markets that countries would want to join without additional incentives. The club, as an autonomous institution, would need to: a) create the conditions for mutual recognition of emission units among members; b) maintain the market infrastructure necessary for trading; c) establish clear criteria for membership; and d) inform assessments of climate mitigation efforts and ambition among current and prospective members. An historical example of how such a club could be initiated and operated is provided, in the international trade domain, by the General Agreement on Tariffs and Trade.

Though the formation of international carbon market clubs was perfectly possible already under the Kyoto Protocol, there is an expectation that they may flourish in the Paris Agreement era. The simple fact that most countries in the world have committed to reducing their emissions, and many of them have declared to intend using carbon pricing, implies that many more opportunities for linking ETSs should arise in the future.Footnote 32 Also, international linking of climate policies, including ETSs, will offer lower abatement costs. It will therefore facilitate the ratchet mechanism on which the Paris Agreement rests to achieve its ultimate objective of climate change mitigation. Furthermore, another way in which the Paris Agreement is expected to expand the opportunities for linking carbon markets is by accounting for emission reductions undertaken by sub- and nonstate actors (Bernstein and Hoffmann 2018; Hale 2016).

No matter how favourable the context related to the international climate change regime may be, carbon market clubs are not expected to materialise quickly, as integrating ETSs is generally a lengthy process. Deep cooperation between the relevant authorities is necessary to prepare and implement the linkage of the given ETSs and then to manage the whole linked system. Santikarn et al. (2018) identify three broad phases of the linking process, namely genesis, negotiation, and implementation. In the first phase, the possibility of linking and the elements of a successful linkage are assessed. In the negotiation phase, authorities gain deeper understanding of the other ETSs, agree a structure for the negotiations and, then, define the details of the linking agreement. The implementation phase sees the operationalisation and launch of the linked market. Important elements of the process are a) the regulatory changes that may be needed to align the ETSs, b) the involvement of stakeholders, and c) the possible establishment of a new institution overseeing the linked market.

5 How Could the EU ETS Impact on Foreign Emissions?

In the previous pages we have reviewed the evolution of the international climate change regime, the experience of the EU ETS in the international carbon market, and the theory of climate clubs. These elements together allow us to imagine why and through which channels the EU ETS may in the future have an impact on GHG emissions outside the EU’s borders.

There are at least two reasons why the relevance of the international dimension of the EU ETS, in this specific respect, may grow in the years to come. The first reason has to do with the fact that while the EU continues to pursue a leadership role in the fight against climate change, its weight in terms of global emissions continues to decline (also as a result of effective policies). It is therefore legitimate to suppose that the EU ETS could be used as a means to stimulating climate action abroad. This conjecture finds support in the arguments of the European Commission explaining the CBAM proposal, one of which is indeed to encourage emission reductions abroad. A second reason why the EU ETS could have a greater impact on foreign emissions is related to the ambitious emission reduction targets that the EU is committed to achieving by 2030 and by 2050. Given these targets, the prospect of increasing abatement costs leads one to think that, together with other measures for costs containment, and within qualitative and quantitative limits, the use of international emission credits for compliance purposes could be readmitted in the EU ETS.

To sum up, both the will to reduce global emissions as much as possible and the need to contain abatement costs, may lead the EU to implement the EU ETS in ways that increase its influence on emissions abroad. Below, we discuss four channels through which this type of outcome could materialise: a) replication, that is, the creation of new ETSs similar to the EU ETS or inspired by it; b) the CBAM proposed by the European Commission; c) the linkage of the EU ETS to the emission crediting mechanism under Article 6.4 of the Paris Agreement; and d) the direct linkage of the EU ETS to other ETSs.Footnote 33

5.1 Reducing Emissions Abroad by Proving to Work Well

The future diffusion of ETSs around the world will depend on the ability of existing ones to prove that they are effective, cost-effective, and both politically and socially feasible policy instruments; in short, tools that work well. The EU ETS as a ‘grand policy experiment’Footnote 34 has been a reference in climate policy, with lessons learned from both its successes and failures. Today, the EU ETS continues to be a pioneer in a new era of climate policy characterised by net-zero emission targets to be reached within three decades or so (Fankhauser et al., 2021). The EU ETS faces new policy and regulatory challenges, which are all the greater given the international nature of the EU ETS itself. How these challenges will be addressed will likely influence other ETSs and potentially even the chances of new ones being created.

In the last turn toward a higher level of climate ambition, the EU confirmed the central role of the EU ETS for achieving its emission reduction targets for 2030 and 2050. Expectations of a further tightening of the cap and of a further strengthening of the Market Stability Reserve,Footnote 35 as proposed by the European Commission, increased the demand for allowances and, thus, raised allowance prices. The EU ETS has undergone an escalation of allowance prices, which reached €90 in early December 2021. Also other factors explain the price escalation, notably exceptionally high prices of natural gas, which favour the use of coal, and speculative trading, among others.Footnote 36 Still, such high carbon prices – much higher than ever before in the EU ETS or in any other comparable ETS (see Fig. 2), but consistent with economically efficient decarbonisation paths (HLCCP 2017) – push two main problems to the fore: negative effects on the international competitiveness of domestic industries and inequitable effects on household budgets.

Until recently, concerns about current competitiveness effects, related carbon leakage, and distributional effects, have been limited thanks to low to moderate carbon prices and reassuring empirical evidence overall (Verde 2020). In the future, however, the EU ETS could only be a model of inspiration for other governments if both competitiveness effects and distributional effects of high carbon prices are successfully addressed. To this end, multiple and innovative levers need to be used in a coordinated way (Verde et al. 2020).

The number and the scope of the recent legislative proposals put forward by the European Commission to reform the EU ETS and more generally to implement the European Green Deal, reflect a clear awareness of this need. The CBAM proposal, in particular, is one that stands out for its innovativeness and significance (see next paragraph). The Just Transition Mechanism is another very relevant and, in some ways, innovative initiative for supporting workers and citizens of the regions most impacted by the energy transition. Further, the Social Climate Fund (SCF) will serve to compensate for distributional effects of a second ETS that, as of 2026, will cover the buildings and transport sectors. Part of the auction revenues from this second ETS will be earmarked to finance the SCF.Footnote 37 These are only few elements of the rich policy mix that will accompany the EU ETS.

5.2 Reducing Emissions Abroad Through the CBAM

Only a couple of years ago, international border carbon adjustments were purely hypothetical measures relegated to the climate policy literature and almost a taboo for most policymakers and observers. How exactly the EU’s CBAM will be designed, together with other anti-leakage measures – first and foremost those directly supporting innovation in low-carbon technologies – will be key both for the effectiveness of the mechanism and for how it will be received by the international community. The European Commission emphasised that its proposed CBAM, which in a first phase would only apply to imports of cement, iron and steel, aluminium, fertilisers, and electricity, is WTO-compatible. In this regard, scholars have warned that a requisite for the compatibility of any border carbon adjustment with WTO rules is a strong and provable environmental rationale (here, climate change mitigation). For this reason, the carbon price applied to subject imports should not be on top of free allocation or other compensation measures already applied to corresponding domestic products. Also, potential export rebates would very likely be considered prohibited export subsidies under WTO rules (Cosbey et al., 2019).

A central aspect of the CBAM is its impact on emissions abroad. In principle, foreign producers exporting to the EU will have an incentive to reduce their emissions so as not to incur additional costs or lose market share in the EU. It is difficult, however, to determine ex-ante whether and to what extent the same producers might respond to the CBAM simply by exporting their less carbon-intensive products to Europe and selling their more carbon-intensive products in other markets. To the best of our knowledge, no study yet exists that quantifies this potential effect or the more general impact of the CBAM on global emissions. In any case, our view is that the value of the CBAM will be better appreciated in the medium to long term, accounting for the policy responses that the CBAM may or may not trigger. For this reason, it will be particularly interesting to see whether the CBAM will be received by foreign governments as an acceptable way of dealing with differences in carbon prices between countries. If so, it is possible to imagine an expansion of jurisdictions with higher and more homogeneous carbon prices than the current situation. Such a scenario involves the formation of carbon market clubs (Sect. 4.2) whose effectiveness in reducing emissions increases with their size.

Arguably, the main obstacle to this type of development is a reluctance to adopt carbon pricing domestically on the part of several countries, first and foremost the US. In the absence of carbon pricing in a country exporting to the EU, the CBAM proposed by the European Commission provides for the application of the full European carbon price to part of the emissions embedded in imports.Footnote 38 The impossibility for that country to bridge the difference in carbon prices – as long as carbon pricing is not introduced domestically – hinders the development of a carbon market club.Footnote 39 Again in the absence of carbon pricing, the abatement cost of regulatory measures could alternatively be estimated and compared with the EUA price. Estimating implicit abatement costs with accuracy, however, would not be straightforward. Another consideration is that the proposed CBAM is supposed to become fully operational only in 2026, and that free allocation is supposed to be fully phased out only by 2035. The transition period, between sole free allocation today and the full CBAM regime in 2035, means EU trading partners would be given some time to adjust.

5.3 Reducing Emissions Abroad by Linking to the Art. 6.4 Mechanism

In the aftermath of the UNFCCC COP26, recently held in Glasgow, experts in international climate negotiations consider the agreement on the rules that operationalise Article 6 of the Paris Agreement an important achievement. As to the rules themselves, these are evaluated as a compromise that broadly provides a good or acceptable (but not faultless) basis for the future international carbon market (see, e.g., Marcu, 2021; Schneider 2021; Stavins 2021). The international crediting mechanism established by Article 6.4 (A6.4 M), in particular, represents a better version of the CDM, superior with respect to environmental integrity standards. Under article 6.4, a country may use the credits generated by the corresponding mechanism toward its own NDC. Whether the EU will at some point decide to link the EU ETS to the A6.4 M – as it did with the Kyoto flexible mechanisms – is, however, an open question.

High carbon prices in the EU ETS lead one to expect that the EU may be tempted to link the system to the A6.4 M, as long as prices of the international credits are lower than domestic abatement costs. On the other hand, the EU’s current NDC clearly spells out that the target for 2030 is to be achieved exclusively through domestic emission reductions: “The EU and its MSs are committed to a binding target of a net domestic reduction of at least 55% in GHG emissions by 2030 compared to 1990”. This suggests that, until 2030 at least, we will probably not see a change in legislation to link the EU ETS to the A6.4 M. If international offsets were to be readmitted in the EU ETS, then the cap (i.e. the number of EUAs to be issued) would have to be reduced accordingly. More plausibly, perhaps, a domestic emission crediting system would be used to exploit – and incentivise – cheaper abatement opportunities in domestic sectors not covered by the EU ETS (e.g. agriculture, forestry and other land use). For these reasons, a linkage of the EU ETS to the A6.4 M seems a more likely development after 2030. However, it is not entirely implausible either that, even before 2030, the EU decides to relax its current exclusive focus on domestic emission reductions. By then, some experience will have been accumulated with the A6.4 M, which would help the EU understand whether linking to it would be convenient.

5.4 Reducing Emissions Abroad by Linking to Other ETSs

A direct linkage between two or more ETSs that have different abatement costs always involves transfers (in opposite directions) of allowances and emissions between the systems. Under Article 6.2 of the Paris Agreement, the allowances that an ETS imports from a linked ETS located in another country are one category of Internationally Transferred Mitigation Outcomes (ITMOs) which the Parties to the Paris Agreement can acquire from other Parties and use toward their NDCs.Footnote 40 Just as previously argued in relation to a potential linkage of the EU ETS to the A6.4 M, the EU’s NDC for 2030 does not incentivise new international linkages of the EU ETS to other ETSs. However, again, the EU’s current exclusive focus on domestic emission reductions could be relaxed in a more or less distant future.

So far, the experience of the EU ETS with direct linkages to other ETSs has been limited, at times frustrating (e.g. the failed linkage with Australia), and – thinking of further direct linkages in the future – not encouraging overall. The many years it took the EU and Swiss authorities to link up the respective ETSs is emblematic of the complexity of ETS linkages, even when good conditions for linking are or seem to be there and the negotiating process has already started. Of course, here too, the future does not need to closely resemble the past. New institutional models could be developed that facilitate the establishment of linkages between ETSs. The Western Climate Initiative, under which the ETSs of California and Quebec have been linked to each other for several years, already provides concrete insights as to how linking as well as de-linking processes could be streamlined. For example, ready-made protocols that both ensure a minimum degree of design homogeneity among ETSs and regulate linking and de-linking processes in some detail, could be very helpful. This would be particularly important to regulate the relationship between the UK and the EU and possibly facilitate a new linking in the future, an option that is frequently discussed in the post-Brexit policy debate.Footnote 41 Similarly, linking agreements that include provisions for post-link maximum and minimum price bounds could facilitate the establishment of full linkages by reducing uncertainty over price control. Thinking about the layout of EU climate policy and of the EU ETS more specifically, notably the current exclusive focus on domestic emission reductions and an institutional aversion to mechanisms for direct control of carbon prices, these potential innovations do not concern the present nor probably the next few years. Later in time, however, things may be different.

6 Conclusions

The international climate change regime has undergone major changes over the past two decades. In many ways, the frameworks established by the Kyoto Protocol and by the Paris Agreement are two different worlds. The transition from one world to the other took several years, causing a prolonged phase of uncertainty. The same changes have had implications for the international dimension of the EU ETS which, as the oldest ETS for domestic climate change mitigation and as a building block of the international carbon market, has lived through them all.

Since its inception, the EU ETS has exerted significant influence on the outside world. Under the Kyoto Protocol regime, the linkage of the EU ETS to the Kyoto flexible mechanisms was the EU’s most relevant initiative. The results of this experience were mixed. On the one hand, the linkage entailed the extension of a carbon price signal to countries and sectors not covered by the EU ETS and it helped developing countries familiarise with emissions trading – China being the most notable example. On the other, the use of international emission credits as emission offsets turned out to be problematic for the EU ETS, both because the inflow of the credits into the system added to a large market surplus – putting further downward pressure on already low carbon prices – and because the environmental integrity of certain credits was dubious. The incorporation of Norway, Iceland and Liechtenstein into the EU ETS was a second relevant experience in the early years of the system.

After the UNFCCC COP15, in Copenhagen, the EU, despite a crisis in international climate negotiations and a strong departure from the type of post-2020 regime it had advocated, did not give up on its ambition to be a leader in the fight against climate change. Nevertheless, its new initiatives involving the international carbon market had modest results. Reasons included: insufficient political support for climate action in potential partner countries; a weak EU ETS, which started to be plagued by a massive market surplus; and, perhaps, insufficient determination on the part of the EU itself. In 2009, the EU had put forward a plan for an OECD-wide carbon market, but the plan was abandoned after the proposal for a federal ETS was rejected by the US Senate. Negotiations were subsequently launched with Australia and Switzerland to bilaterally link the EU ETS with the ETSs of those two countries. The first linkage eventually did not take place because the new Australian government was opposed to it. Conversely, the linkage with the Swiss ETS entered into force in January 2020, after a very long negotiation process. In parallel, the EU has continued contributing to international carbon market cooperation in other forms, notably by financing capacity building programmes and policy dialogues on ETSs and carbon markets more generally.

In the Paris Agreement era, the EU has once again raised its climate ambition by launching the European Green Deal. In this context, the ability of the EU ETS to have an impact on foreign emissions – a focus of our analysis, given the shrinking weight of the EU in global emissions – may grow in the years to come. In particular, we have considered four potential channels through which the EU ETS may reduce emissions abroad: a) replication, that is, the creation of new ETSs similar to the EU ETS or inspired by it; b) the CBAM proposed by the European Commission; c) the linkage of the EU ETS to the emission crediting mechanism under Article 6.4 of the Paris Agreement; and d) the direct linkage of the EU ETS to other ETSs. The UNFCCC COP26, recently held in Glasgow, marked a critical step in the development of the future international carbon market, thanks to the reaching of an agreement on the rules operationalising Article 6 of the Paris Agreement. The EU’s preceding decision to focus on reducing domestic emissions only, until at least 2030, suggests that we will probably not see new international linkages between the EU ETS and other carbon markets in the current decade. On the other hand, it is not entirely implausible that, even before 2030, the EU will revisit its past decision and relax its exclusive focus on domestic emission reductions.

In any case, the EU ETS may still have a significant impact on foreign emissions already in the present or in the near future. This is where the first two channels come into play. By proving to work well – meaning demonstrating to be environmentally effective, economically efficient, as well as politically and socially feasible – the EU ETS may influence other ETSs and potentially even the chances of new ones being created. Indeed, while a growing number of countries shows interest in using carbon pricing, there is also a growing need for examples of carbon pricing implemented in the context of net-zero emission targets. Key will be whether competitiveness effects and distributional effects of high carbon prices are successfully addressed. Several companion policies that will be part of the new policy mix, such as the CBAM, the Just Transition Mechanism, and the Social Climate Fund, among others, are relevant in this respect.

The CBAM proposed by the European Commission is an absolute novelty in climate policy-making and one showing how climate change is a sufficiently big problem to force institutions beyond the status quo – in this case, challenging the codes of international trade relations. The proposed CBAM will not only serve the EU to reduce the risk of carbon leakage, but it will also incentivise emission reductions in countries exporting to the EU. Thus, it will be particularly interesting to see whether the CBAM will be received by foreign governments as an acceptable way of dealing with differences in carbon prices between countries. If so, it is possible to imagine an expansion of jurisdictions with higher and more homogeneous carbon prices than the current situation. In effect, this is a scenario in which carbon market clubs develop. Related to this eventuality, an important question that the EU will soon need to address is whether to allow for comparability of estimated abatement costs, in countries without carbon pricing (e.g. the US today), to EUA prices. At the risk of oversimplifying, the tradeoff is between technical accuracy of the CBAM and its potential to induce greater abatement efforts in countries that remain opposed to explicit carbon pricing domestically.

Change history

01 August 2022

A Correction to this paper has been published: https://doi.org/10.1007/s10640-022-00715-9

Notes

Launched in December 2017, China’s national ETS started operating in the summer of 2021. The volume of emissions covered by China’s ETS, in its current phase, is about twice that of the EU ETS (ICAP 2021).

For a comprehensive account of the history of the international climate regime, till 2012, see Gupta (2014). For analyses of the Kyoto Protocol and of the Paris Agreement, see Grubb (2003) and Falkner (2016), respectively. To understand how we got to the Paris Agreement, see Bodansky (2011) and Victor (2011).

The national emissions reduction targets are found in Annex-B of the Kyoto Protocol.

Emission targets were expressed as levels of allowed emissions, or assigned amounts, over the commitment period. The allowed emissions were partitioned into AAUs.

The 36 countries that committed to emission reductions only accounted for 24% of global emissions in 2010 (Shishlov et al., 2016).

While Canada withdrew from the Kyoto Protocol already in 2011, other major emitters like Japan and Russia decided not to take up new emissions reduction commitments for the period 2013-2020. The principle of a second commitment period of the Kyoto Protocol was agreed at COP17, in 2011, and formalised at COP18 in Doha (Qatar), the year after. The Doha Amendment to the Kyoto Protocol came into force only on 31 December 2020, the last day of the Kyoto second commitment period.

At the time of writing (January 2022), 192 countries and the EU have ratified the Paris Agreement.

For example, the first NDC committed by the EU was “a binding target of an at least 40% domestic reduction in greenhouse gas emissions by 2030 compared to 1990”. The first NDC committed by China was articulated as follows: “To achieve the peaking of carbon dioxide emissions around 2030 and making best efforts to peak early; To lower carbon dioxide emissions per unit of GDP by 60% to 65% from the 2005 level; To increase the share of non-fossil fuels in primary energy consumption to around 20%; and To increase the forest stock volume by around 4.5 billion cubic meters on the 2005 level.” All submitted NDCs can be found on the UNFCCC website.

For a legal analysis of the Paris Agreement, see Bodansky (2016).

The idea of a bottom-up polycentric approach to address climate changes precedes COP15. See, e.g., Ostrom (2014).

Sabel and Victor (2016) hailed the Paris Agreement not as “a consoling alternative to failure […], but as a superior way to coordinate action in the face of massive uncertainty about the interests, capabilities, and intents of the key players. It is not a time-consuming detour on the way to the main goal but rather the only viable path to achieving radical transformations in national policies that lead to deep cuts in emissions”.

By reducing the cost of meeting the NDCs, international cooperation creates space for increasing ambition in climate mitigation. Cooperation as an enabler of increased ambition characterises the Paris Agreement. It has been estimated that, by the middle of this century, an international carbon market has the potential to reduce global mitigation costs by over 50% (World Bank, Ecofys and Vivid Economics 2016).

For a detailed comparison of market-based mechanisms in the Paris Agreement and in the Kyoto Protocol, see Schneider et al. (2016).

Analysing or summarising the rules operationalising Article 6 is beyond the scope of this study. The interested reader is referred to Marcu (2021). Nevertheless, our analysis takes into account the results of COP26.

The text of the Paris Agreement can be found on the UNFCCC website.

For further reflections on Article 6.2, before COP26, see Marcu et al. (2017) and Marcu and Zaman (2018).

Mehling et al. (2018b) illustrate how climate policies other than ETSs could be linked under Article 6.

For an analysis of Article 6 pilot projects, see Greiner et al. (2019).

The interested reader is referred to the work programme for non-market approaches defined at COP26, which is available on the UNFCCC website.

European Union Allowances issued under the EU ETS were matched one to one with AAUs from the issuing Member State.

For a detailed explanation of the relationship between the EU ETS and the international carbon market, see Ellerman et al. (2010).

On the relationship between EUA prices and CER prices, see Hintermann and Gronwald (2019) and Gavard and Kirat (2021).

Installations that were already under the EU ETS in Phase II could use credits in the period 2008-2020 up to 11% of their Phase II allocation. For new entrants, the limit was 4.5% of verified emissions in Phase III (European Commission, 2015).

Otherwise, corresponding adjustments to allowance supply would have been needed. In an ETS, any pressure of emission credits on allowance prices can be neutralised by cancelling one allowance for each credit entering the system.

The abatement of emissions abroad was not additional to that induced by the EU ETS in Europe: it substituted for domestic abatement, as the use of CERs/ERUs for compliance in the EU ETS de facto (in the absence of corresponding adjustments) raised the cap.

Approximately 50 companies, which collectively emit around 5.5 million tonnes of CO2, participate in the Swiss ETS (Swiss Federal Office for the Environment, 2015).

Before the 2013 elections, Australia’s government adopted the Carbon Pricing Programme, which involved an ETS starting in 2015.

E.g., the Carbon Disclosure Project (www.cdp.net).

In theory, the main rationale (not the sole one) for linking two or more ETSs is the achievement of an economic efficiency gain: through trade of emission allowances and hence full or partial equalization of marginal compliance costs, linked ETSs can deliver on their mitigation targets at a lower cost. However, the achievement of this efficiency gain may not suffice for a linkage to be considered convenient by all the jurisdictions involved. Notably, linking entails monetary and abatement transfers across jurisdictions which need to be tolerated. But tolerance is not granted: local co-benefits of emissions abatement are valuable and international transfers may not be welcome. Also, domestic distributional effects and general equilibrium effects matter. Policymakers will weigh up all these factors in the light of multiple policy objectives (Flachsland et al., 2009). Moreover, different forms of ETS linkages exist: unilateral/bilateral/multilateral, direct/indirect, full/restricted. Several studies analyse their various implications. See, e.g., Lazarus et al. 2015, Borghesi et al. 2016, Schneider et al. 2017, Quemin and de Perthuis, 2017, Borghesi and Zhu 2020.

Over 80 national governments declared that they intend to use carbon pricing for meeting their NDCs (Marcu and Sugathan, 2018). The share of global emissions covered by ETSs has tripled since the launch of the EU ETS in 2005 (ICAP 2021).

In both cases, c) and d), ordinary ‘hard’ linkages are intended. This remark relates to the distinction between hard and soft linkages mentioned in the Introduction.

This expression is borrowed from Stavins (1998), who used it for the SO2 Allowance Trading System.

In operation since 2019, the Market Stability Reserve is a mechanism aimed at correcting supply–demand imbalances in the EU ETS through withholdings and injections of EUAs to be auctioned.

On the role of speculation in ETSs, see Quemin and Pahle (2021).

Given the high current energy prices, some experts have proposed to de facto bring forward the implementation of the SCF using the proceeds of the EU ETS auctions (Cornillie and Delbeke, 2021).

In the CBAM proposed by the European Commission, the carbon price applied to imports is calculated depending on the weekly average auction price of EUAs. The CBAM applies only to the proportion of emissions that does not benefit from free allowances under the EU ETS.

This is another reason why demonstrating that existing ETSs work well is important: the more governments are persuaded to adopt carbon pricing, the easier it becomes to develop carbon market clubs.

On accounting rules for ETS linkages under Article 6.2, see Schneider et al. (2018).

The UK exit from the EU ETS after Brexit represented an important discontinuity in the system given the major role played by the UK in the EU ETS both in terms of emissions volume and centrality in the exchange of allowances. For in-depth analyses of the possible consequences of the UK withdrawal from the EU ETS on both partners, see Babonneau et al. (2018), Tol (2018), Borghesi and Flori (2019).

References

Andresen S (2014) Exclusive approaches to climate governance: more effective than the UNFCC? In: Cherry, T.L., Hovi, J. and McEvoy, D.M. (eds.), Toward a New Climate Agreement, Routledge: London.

Arup C, Zhang H (2015) Lessons from regulating carbon offset markets. Transl Environ Law 4(1):69–100

Asian Development Bank (2018), Decoding Article 6 of the Paris Agreement.

Babonneau F, Haurie A, Vielle M (2018) Welfare implications of EU effort sharing decision and possible impact of a hard Brexit. Energy Econ 74(12):470–489

Bӓckstrand K, Elgstrӧm O (2013) The EU’s role in climate change negotiations: from leader to “leadiator.” J Eur Publ Policy 20(10):1369–1386

Bernstein S, Hoffmann M (2018) The politics of decarbonization and the catalytic impact of subnational climate experiments. Policy Sci 51(2):189–211

Betz R (2017) Linking the Swiss and EU Emissions trading schemes (ETS): Risks and benefits. Swiss Competence Centers for Energy Research.

Bodansky D (2011) A tale of two architectures: the once and future U.N. climate change regime. Ariz State Law J 43:697–712

Bodansky D (2016) The legal character of the Paris Agreement. Rev Eur Community Int Environ Law 25(2):142–150

Borghesi S, Flori A (2019) With or without you: A pre-Brexit network analysis of the EU ETS. PLoS ONE. https://doi.org/10.1371/journal.pone.0221587,pp.1-17

Borghesi S, Montini M, Barreca A (2016) The European Emission Trading System and its followers: Comparative analysis and linking perspectives, Springer.

Borghesi S, Verde SF, Zhu T (2018) The international dimension of the EU Emissions Trading System, Policy Brief RSCAS 2018/21, European University Institute.

Borghesi S, Zhu T (2020) Getting married (and divorced): A critical review of the literature on (de)linking Emissions Trading Schemes. Strateg Behav Environ 8(3):219–267

Buchanan JM (1965) An economic theory of clubs. Economica (new Series) 32(125):1–14

Bultheel C, Morel R, Alberola E (2016) Climate Governance & the Paris Agreement: the Bold Gamble of Transnational Cooperation, I4CE Climate Brief No.40.

Cames M, Healy S, Tänzler D, Li L, Melnikova J, Warnecke C, Kurdziel M (2016) International market mechanisms after Paris, Discussion Paper. DEHSt/UBA, Berlin

Cames, M., Harthan, R.O., Fussler, J., Lazarus, M., Lee, C.M., Erickson, P. and R. Spalding-Fecher (2016b), How Additional is the Clean Development Mechanism? Analysis of the application of current tools and proposed alternatives, Prepared for DG Clima (CLlMA.B.3/SERl2013/0026r.) by Oko-Institut, INFRAS and Stockholm Environment Institute.

Carbon Market Institute (2017), Operationalizing Article 6 of the Paris Agreement: Perspectives of Australian Business.

Carbon Market Watch (2016) Recommendations for Article 6 of the Paris Agreement: Prepared for the Bonn Climate Change Conference 16–26 May 2016.

Carraro C (2016) Clubs, R&D, and climate finance: incentives for ambitious GHG emission reductions, in: Stavins, R.N. and R.C. Stowe (eds.), The Paris Agreement and beyond: international climate change policy post-2020, Harvard Project on Climate Agreements, Cambridge (Massachusetts, US).

Chan G, Stavins R, Ji Z (2018) International climate change policy. Ann Rev Resour Econ 10:335–360

Cosbey A, Dröge S, Fischer C, Munnings C (2019) Developing guidance for implementing border carbon adjustments: lessons, cautions, and research needs from the literature. Rev Environ Econ Policy 13(1):3–22

Dahan L, Vaidyula M, Afriat M, Alberola E (2016) The Paris Agreement: a new international framework to facilitate the uptake of carbon pricing, I4CE Climate Brief No.39, Institute for Climate Economics, Paris (France).

de Bruyn S, Schep E, Cherif S, Huigen T (2016) Calculation of additional profits of sectors and firms from the EU ETS 2008–2015, Delft: CE Delft.

Ellerman AD, Convery FJ, De Perthuis C (2010) Pricing carbon: the European Union emissions trading scheme. Cambridge University Press. Pp. 54.

Englert D (2015) Case study: Linking the Swiss and EU ETS, First Climate.

European Commission (2011) Commission Regulation (EU) No 550/2011 of 7 June 2011 on determining, pursuant to Directive 2003/87/EC of the European Parliament and of the Council, certain restrictions applicable to the use of international credits from projects involving industrial gases, Brussels, European Commission.

European Commission (2021a) Proposal for a Directive of the European Parliament and of the Council amending Directive 2003/87/EC establishing a system for greenhouse gas emission allowance trading within the Union, Decision (EU) 2015/1814 concerning the establishment and operation of a market stability reserve for the Union greenhouse gas emission trading scheme and Regulation (EU) 2015/757, Brussels, European Commission.

Commission E (2021) Proposal for a Regulation of the European Parliament and of the Council establishing a carbon border adjustment mechanism. European Commission, Brussels

European Commission (2021c) Commission Staff Working Document Accompanying the document Report from the Commission to the European Parliament and the Council on the Functioning of the European Carbon Market in 2020 pursuant to Articles 10(5) and 21(2) of Directive 2003/87/EC (as amended by Directive 2009/29/EC and Directive (EU) 2018/410), Brussels, European Commission.

European Parliament and Council (2004) Directive 2004/101/EC of the European Parliament and of the Council of 27 October 2004 amending Directive 2003/87/EC establishing a scheme for greenhouse gas emission allowance trading within the Community, in respect of the Kyoto Protocol’s project mechanisms, Brussels, European Parliament and Council.

European Parliament and Council (2021) Regulation (EU) 2021/1119 of the European Parliament and of the Council of 30 June 2021 establishing the framework for achieving climate neutrality and amending Regulations (EC) No 401/2009 and (EU) 2018/1999 (European Climate Law). European Parliament and Council, Brussels

Falkner R (2016) The Paris Agreement and the new logic of international climate politics. Int Aff 92(5):1107–1125

Fankhauser S, Smith SM, Allen M, Axelsson K, Hale T, Hepburn C, ..., Wetzer T (2021) The meaning of net zero and how to get it right, Nature Climate Change, 1–7.

Teng F (2021) Evolution of climate diplomacy in China, EAERE Magazine, 12.

Flachsland C, Marschinski R, Edenhofer O (2009) To link or not to link: Benefits and disadvantages of linking cap-and-trade systems. Climate Policy 9(4):358–372

Fuessler J, Herren M, Wunderlich A, Michaelowa A, Matsuo T, Honegger M, Hoch S (2015) Market mechanisms: Incentives and integration in the post-2020 world, Zurich: INFRAS.

Gavard C, Kiret D (2020) Short-term Impacts of Carbon Offsetting on Emissions Trading Schemes: Empirical Insights from the EU Experience, Discussion Paper n°20–058, ZEW - Leibniz Centre for European Economic Research.

Greiner S, Chagas T, Krämer N, Michaelowa A, Brescia D, Hoch S (2019) Moving towards next generation carbon markets – Observations from article 6 pilots, Climate Finance Innovators, Freiburg.

Green JF (2017) The strength of weakness: pseudo-clubs in the climate regime. Clim Change 144:41–52

Grubb M (2003) The economics of the Kyoto Protocol. World Econ 4(3):143–189

Gupta J (2014) The history of global climate governance. Cambridge University Press

Hale T (2016) All hands on deck: the Paris Agreement and nonstate climate action. Glob Environ Polit 16(3):12–22

Hintermann B, Gronwald M (2019) Linking with Uncertainty: The Relationship Between EU ETS Pollution Permits and Kyoto Offsets. Environmental and Resource Economics, 1–24.

HLCCP (2017) Report of the High Level Commission on Carbon Prices. World Bank, Washington, DC

Hovi J, Sprinz DF, Saelen H, Underdal A (2016) Climate change mitigation: a role for climate clubs? Palgrave Commun, Palgrave Macmillan 2(1):1–9

ICAP (2021) Emissions trading worldwide: Status report 2021. International Carbon Action Partnership, Berlin

IETA (2017) Article 6 of the Paris Agreement Implementation Guidance – An IETA ‘Straw Proposal’, International Emissions Trading Association.

Keohane RO, Oppenheimer M (2016) Paris beyond the climate dead end through pledge and review? Polit Gov 4(3):142–151

Keohane N, Petsonk A, Hanafi A (2017) Toward a club of carbon markets. Clim Change 144:81–95

Lazarus M, Schneider L, Lee C, van Asselt H (2015) Options and Issues for Restricted Linking of Emissions Trading Systems, International Carbon Action Partnership.

Marcu A (2016a) Carbon market provisions in the Paris agreement (Article 6), Centre for European Policy Studies.

Marcu A (2016b) International Cooperation under Article 6 of the Paris Agreement, International Centre for Trade and Sustainable Development.

Marcu A (2016c) Governance of Carbon Markets under Article 6 of the Paris Agreement, Harvard Project on Climate Agreements.

Marcu A (2017) Governance of Article 6 of the Paris Agreement and Lessons Learned from the Kyoto Protocol, Centre for International Governance Innovation.

Marcu A, Sugathan M (2018) Northeast Asia carbon markets and trade connections – An Asia Society Policy Institute Report produced in collaboration with the International Centre for Trade and Sustainable Development (ICTSD), Asia Society Policy Institute (ASPI), New York.

Marcu A, Vangenechten D, Martin-Harvey O, González Holguera S (2017) Issues and Options: Elements for Text under Article 6.

Marcu A, Zaman (2018) ‘Straw man’ guidance on cooperative approaches referred to in Article 6, paragraph 2 of the Paris Agreement, International Centre for Trade and Sustainable Development.

Mehling M, Metcalf G, Stavins R (2018) Linking climate policies to advance global mitigation. Sci 359(6379):997–998

Mehling M, Metcalf G, Stavins R (2018) Linking heterogeneous climate policies (consistent with the Paris Agreement). Environ Law 48(4):1–37

Nordhaus W (2015) Climate clubs: overcoming free-riding in international climate policy. Am Econ Rev 105(4):1339–1370

OECD (2021) Effective Carbon Rates 2021: Pricing Carbon Emissions through Taxes and Emissions Trading. OECD Publishing, Paris

Olsen KH, Arens C, Mersmann F (2018) Learning from CDM SD tool experience for Article 64 in the Paris Agreement. Clim Pol 18(4):383–395

Ostrom E (2014) A polycentric approach for coping with climate change. Ann Econ Financ 15(1):97–134

Ostrom E (2015) Governing the commons: the evolution of institutions for collective action. Cambridge University Press

Quemin S, de Perthuis C (2017) Transitional restricted linkage between Emissions Trading Schemes, RePEc working paper No. 1701.

Quemin S, Pahle M (2021) Financials threaten to undermine the functioning of emissions markets, Mimeo.

Sabel CF, Victor DG (2016) An evolutionary approach to governing global problems – Climate policy after Paris, Policy Analysis Brief, The Stanley Foundation.

Santikarn M, Li L, La Hoz Theuer S, Haug C (2018) A guide to linking emissions trading systems, International Carbon Action Partnership (ICAP), Berlin.

Schneider L (2021) COP26 in Glasgow delivered rules for international carbon markets – how good or bad are they?, OEKO Blog, 15 November 2021.