Completing the move to Universal Credit: Learning from the Discovery Phase

Published 10 January 2023

Applies to England, Scotland and Wales

Introduction

Universal Credit (UC) has streamlined and simplified the benefits system by combining six “legacy”[footnote 1] benefits into a single monthly payment.

By the end of 2018, UC was rolled out to all Jobcentres for new claimants and as of August 2022 there were 4.2m households in payment on UC. However, there remain 2.5m households claiming legacy benefits and tax credits who have yet to move over to UC. Moving those remaining claimants will ensure that the policy goals of UC are fully realised and enable relevant legacy systems to be scaled down or closed entirely.

Our strategy for moving these remaining households to UC is formed of three “tracks” of migration – natural, voluntary and managed, as set out in the department’s Completing the Move to UC document[footnote 2], published in April 2022.

This document focusses on the first cohort of Migration Notices issued as part of our managed migration Discovery work on Move to UC. It explains what Discovery is, the process employed by the department for moving people from legacy benefits to UC and critically, what we have learned so far on a range of key areas. These include the claims process, terminations, where claims are not made, Transitional Protection and the support needs of those moving to UC. The document also includes a breakdown of the data relating to this initial cohort.

Summary

We have learnt a great deal from the Discovery phase and have developed our approach based on this learning. The circumstances for every household are different, but Discovery has shown us that on the whole households are able to make the move to UC. In line with our assumptions claimants on tax credits appear to be more digitally capable and able to make the move with less support. We have focused the later phases of Discovery on tax credit only cases to test different approaches around engagement to maximise the number of people making a claim. There is more we still need to test, including how we engage with a greater number of claimants at the same time, increasing the understanding around Transitional Protection and finding the optimal time to engage with different claimants. Overall, the evidence from Discovery is positive and provides us with confidence that we can safely transition claimants to UC.

What is Discovery?

In January 2022, we restarted the design work on managed migration with a Discovery phase – the focus being to learn how to successfully move people to UC. Although we refer to this process as ‘managed migration’, every individual will need to make a claim themselves to move to UC.

As we move through the Discovery phase, we are focused on learning:

- How we can successfully identify different groups of people to move to UC.

- What will motivate people to move and make a claim.

- The degree to which different groups of claimants need support to successfully make their claim.

- How we can accurately calculate and pay their award, including Transitional Protection.

- What we need in place in order to scale our ability to identify people, deliver support and calculate and pay the UC award, including Transitional Protection.

We are working closely with HMRC and Local Authorities, and HMRC colleagues are embedded within UC product teams to develop processes and draw in learnings.

For the first managed migration test (Earliest Testable Service) we issued 499 Migration Notices in May, in Bolton and Medway. We established a service centre to track the journey of these first claimants, with a dedicated phone line to provide claimants with additional support if required. Those in need of further support were able to visit their local jobcentre to seek further advice and guidance.

It is important to emphasise that the Earliest Testable Service (ETS) is not a pilot of the proposed approach we will roll out nationally. It is intentionally a baseline service that we used with a small number of single person households to test, learn and adapt our approach and to see where claimants need further support. The outputs from ETS need to be seen in this context. They are not in themselves predictors of how a future service will operate at a national level. Rather, ETS was designed as a first step in our discovery work. As we continue to learn, later iterations of the service will include features and adaptations to resolve the issues we identified in Discovery.

This document focuses on the ETS cohort.

Since May, we have expanded Discovery and notified more people in Bolton and Medway as well as expanding to Cornwall in July, Harrow in August, and Northumberland in September.

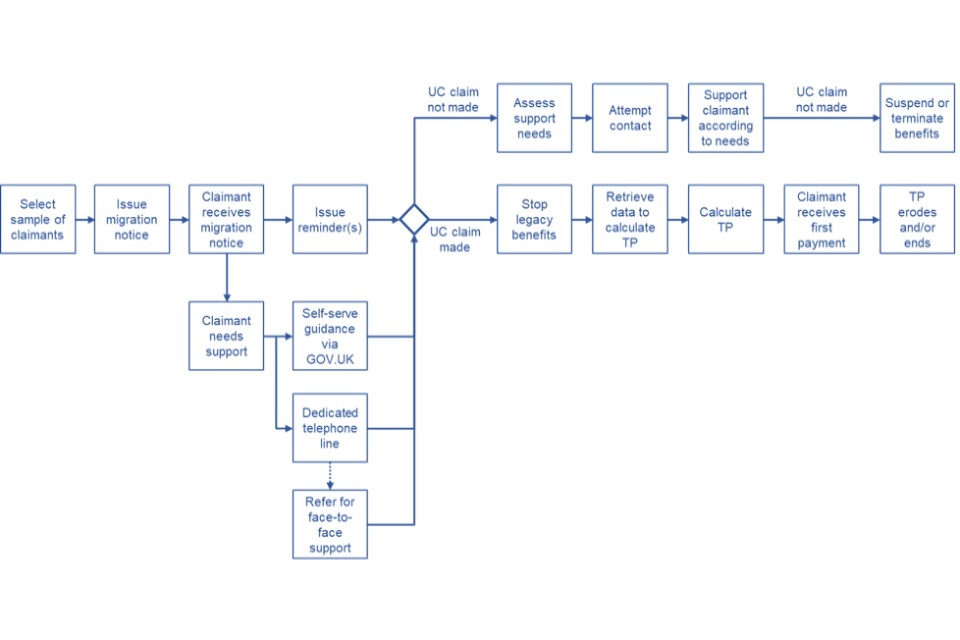

Chart 1 below sets out the managed migration process that was tested in the ETS cohort.

Chart 1 – The managed migration process for ETS

A claimant receiving one or more of the relevant legacy benefits is issued with a Migration Notice informing them that to continue receiving financial support they must claim UC by the deadline date given in the letter. This is three months from the date the letter was sent out. The Migration Notice signposts claimants to specific pages on GOV.UK where they can find more information or claim UC, and to a dedicated helpline where they can access support to make a claim. A claimant will receive reminders during the three-month period if they have not yet claimed UC; for the ETS cohort this was after around 8 weeks. The Migration Notice also explains how to request an extension to the deadline if needed.

When a notified person makes a claim to UC before their deadline date, they will be asked to verify their identity, accept their claimant commitment, and undertake any relevant verification activity as with any other UC claim. Their legacy benefit(s) are also terminated, with any run on paid as appropriate. At the end of the first assessment period eligible claimants will receive Transitional Protection if the amount they were entitled to on their legacy benefit(s) is more than they would be entitled to on UC. The amount and reason for the Transitional Protection is displayed on the claimant’s statement. The claimant is also informed if they do not receive Transitional Protection because their UC entitlement is the same or higher than on their legacy benefit(s).

If a notified person does not make a claim by their deadline date, then their legacy benefit(s) will be terminated. However, to support our learning for the initial Discovery cohorts, claimants received a one-month extension as well as text messages and phone calls to encourage and support them to claim before their extended deadline. Additional support was also made available during this period as needs were identified, including home visits where appropriate. If a claimant did not claim by their extended deadline, they were notified that their current benefit(s) would be terminated unless they had significant support needs requiring a further extension.

For those claimants who have their benefits terminated, if they make a UC claim within one month of their benefit being terminated, they have their claim backdated to their deadline date and still receive Transitional Protection where entitled.

Learning from Discovery so far

Our Discovery work is focused on learning what works and developing the service. These learnings are set out below, and we have been encouraged by our early findings. Annex A also sets out some of the key management information from discovery for the ETS cohort, where data is more complete.

Our learning has been developed through a programme of observation, research (both internal and commissioned through Ipsos), and analysis examining all aspects of the Move to UC Discovery. This work includes in depth interviews with claimants and staff, analysis of migration data, claimant insight to assess the content design of Migration Notices and other products and assessment of telephony contact and claimant support services.

Migration Notices and reminders

Research conducted with claimants receiving a Migration Notice as part of the ETS found that respondents generally understood the Migration Notice letter, the requirement to claim UC before the given deadline and that the letter was directing them to act and to apply for UC online. Most respondents also appreciated that there would be implications for their existing benefits if they did not act before the deadline. Reminders were an important prompt at encouraging people to move to UC or investigate making a claim.

Some claimants knew they would need to make an online claim but were unsure how to begin or where to get help. This was particularly true for older claimants and those without digital skills. Others were frustrated at needing to make a new claim, they did not understand why they could not be moved over automatically.

Some claimants suggested the Migration Notices could be improved by including an explanation of why they were being asked to move to UC. It was also noted that a list of specific documentation needed to make a claim would be helpful. A small number of respondents noted that they had recently renewed their tax credit claim and were left wondering if the Migration Notice applied to them.

Wider perceptions of UC also influenced how people received the Migration Notice. Some people said they had heard about UC from others and expected to be asked to move to the benefit at some point. Others felt the UC application process was ‘just another admin task’ and they were broadly confident with filling in online forms. These views were particularly true of those people in work.

We are encouraged with the overall responses from individuals who have received the Migration Notice. We take careful note of all feedback and where the feedback has been more critical, that is beneficial to us in refining the products we use.

Support and contact

Many claimants consulted other resources before making their claim. A dedicated telephone helpline was established to support claimants in making a claim and address any concerns or queries they have about the Move to UC process. The telephone number was highlighted in the Migration Notice and reminder notifications.

The helpline was the main point of contact, and the experience was positive. The helpline has proved to be helpful in supporting customers through the process and we are very pleased with the way it is performing.

Of the 499 claimants issued a Migration Notice in the ETS cohort, 179 people (36%) chose to contact the telephone line for support. Of that group, 66 people (37%) contacted the helpline more than once. Claimant contact via the telephone helpline was for a number of reasons as set out in Table 2.

Table 1 - Top reasons for contacting the Move to UC Helpline (ETS Cohort)[footnote 3]

| Reason | Proportion |

|---|---|

| Advice on how to make a claim / what do I need | 65% |

| I do not have access to the Internet / device / unable to an online claim | 30% |

| Concerns about payments, including Alternative Payment Arrangement (APA) | 11% |

| What happens if I do not make a claim | 6% |

| What documents do I need / not sure I have the right ones | 5% |

The research reported that people generally found telephony staff to be helpful and provided reassurance about the claim process. It was also noted that staff were helpful in arranging advances and changing payment dates from monthly to twice a month where required. Some calls required agents coaching claimants to make a claim - what to do, where to go, how to make a claim, payments and Transitional Protection.

Claimants visited a range of other resources to find out more information including GOV.UK, welfare rights organisations, family and friends. We tested the guidance on GOV.UK and whilst claimants generally understood the guidance, it was felt there is too much content for most claimants to be able to take in and understand, and many will only read some parts of the guidance. This is currently being reviewed.

Claimants in supported living rely heavily on support workers to understand the Migration Notice and progress the claim and some claimants got advice and help from community support including GPs, schools, and religious centres.

The claim process

As set out above, ETS represents an early, baseline formulation of the service from which we can learn. Out of the 499 Migration Notices issued to claimants in the ETS cohort 439 (88%) have made a claim. Of the remainder, 7 claimants are still to make a claim, 2 Migration Notices have been cancelled and 51 claims to legacy benefits have been terminated (49 tax credit claims and 2 from other DWP benefits).

Overall, we view this as a very positive early outcome for the Discovery process, suggesting that most people will move across without the need for additional support. It is also worth noting that nearly all of the terminations made are tax credit claimants and we are analysing these cases to see if there are any trends or learning points. We recognise that the likelihood of vulnerabilities amongst Employment and Support Allowance (ESA) claimants is higher and have not terminated these remaining 7 ESA claims.

Where claimants have not yet claimed UC and we are aware they have enhanced support needs, we are taking steps to provide the necessary support to enable a successful claim to UC. We have used our Visiting Service to engage claimants face-to-face where they didn’t respond to letters, SMS messages or phone calls. This has enabled us to better understand the barriers faced and provide suitable assistance in making a UC claim, including making supported telephone claims.

For those claimants who require significant support, beyond what a visiting officer could provide, we have held case conferences with the local Advanced Customer Support Senior Leaders (ACSSLs). They provide local expertise, working with different organisations to take a multi-agency approach to supporting our most vulnerable claimants. In several cases we have used ACSSLs to assist in tracing and contacting the claimant, where a home visit wasn’t appropriate or effective.

In other cases, we, with support of the ACSSLs are engaging with external organisations to provide support to those who are homeless and/or have significant issues with alcohol dependency. These claimants are unable to make a claim without significant support and may require either help from a friend or relative and if not available, we may need to arrange representation from a corporate appointee.

By using visiting officers and ACSSLs we have managed to contact all claimants with enhanced support needs nearing the end of their migration period thus far.

Finding suitable support mechanisms for this small but vulnerable cohort of claimants has meant significant extension to their migration periods. Termination of their legacy benefits is not appropriate as it is not an unwillingness to engage or claim, but an inability to do so either by themselves or with the support offered thus far.

Some claimants contacted the department to explain they could not make a claim online and would like to make the claim via the telephone. The main reasons cited for being unable to make a claim online included having a health condition preventing them from using a digital device, having limited digital capability and not having access to the internet. To date, 63 claimants from the ETS cohort have applied for UC by telephone, representing 14% of all benefits units who moved to UC. Of these 81% were on previously ESA claimants.

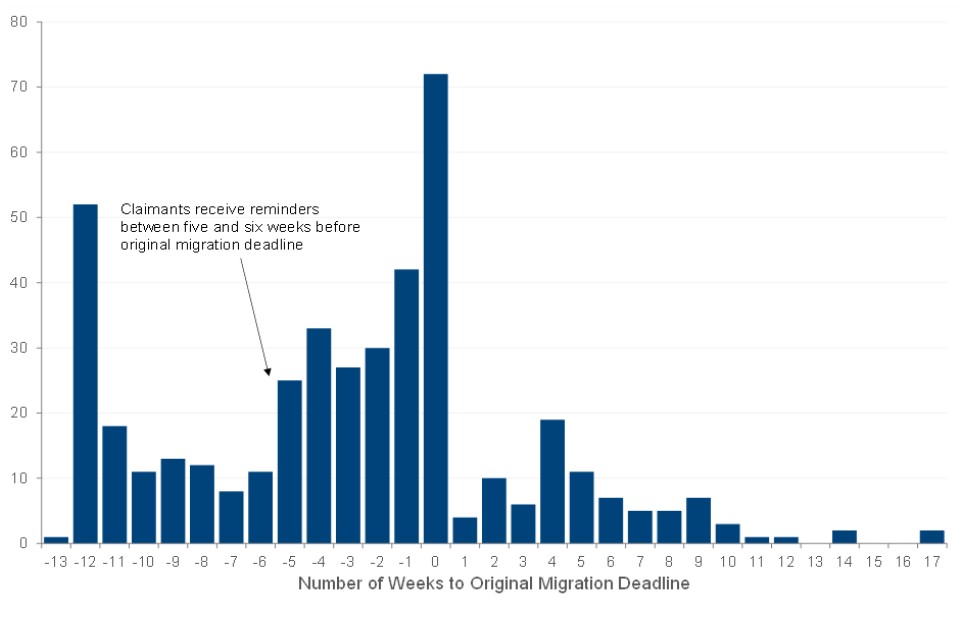

The points at which claims were made over the migration period within the ETS cohort revealed a pattern of claimant behaviour that shows peaks of claiming corresponding closely to the issuing of the initial Migration Notice, the reminder notifications and the claim deadline (see Chart 2). It also shows that a significant proportion of claimants delay taking action until close to the Migration Notice deadline.

Chart 2 – Count of claims made by number of weeks between migration deadline and UC claim

Those who chose to claim very soon after receiving their Migration Notice fell into two broad categories: (1) the digitally literate who expressed confidence in making an online application (who tended to be in work); and (2) individuals concerned that any delay in making an application could influence the timing their benefit payments.

Those claimants who did not claim immediately did so for a variety of reasons including waiting for support from family, dealing with a family emergency, recovering from an illness or looking after children during school holidays. Some respondents felt they needed to maximise their financial position before moving, so were waiting for a benefit or Cost of Living Payment to be made. Others stated they were reluctant to move to UC because of concerns they would receive less benefit and wanted to stay on their current benefit(s) as long as possible. A small number of people admitted they had forgotten about the Migration Notice until they received a reminder letter.

Transitional Protection

Transitional Protection is a key element of Move to UC and ensures that those eligible households with a lower calculated entitlement in UC than their legacy benefit award will see no difference in their entitlement at the point they are moved to UC, provided their circumstances remain the same. The Transitional Protection element will erode over time with increases in UC elements - excluding the childcare costs element - and will stop with certain changes of circumstances.

Of the 423 claimants in the ETS cohort who are now on UC and have had a statement, 213 claims (50%) were awarded Transitional Protection.

There is some evidence that shows claimants do not fully understand how Transitional Protection is calculated. We are addressing this issue in a number of ways including through reviewing guidance on GOV.UK, ensuring DWP staff answering telephone calls can provide clear and concise advice and through regular discussions with our stakeholder community.

The no claim process, deadline extensions and terminations

Within the ETS, all claimants who had not made a claim by their original deadline date were granted a one-month extension to their migration deadline. 40 claimants with enhanced support needs were given a further extension, either because the claimant requested more time or because we had been unable to engage the claimant. 12 claimants were referred for a home visit.

Within the ETS cohort who have made a claim to date:

- 81% claimed by their original migration deadline.

- 14% claimed within the first 2 weeks of being sent their Migration Notice.

- 55% claimed by their original deadline having had a reminder.

- 16% claimed in the week leading up to their original migration deadline.

- 13% claimed between their original and extended deadlines.

- 6% claimed after their extended deadline.

Outbound texts and up to 3 telephone calls were made to individuals who had not claimed to ensure they fully understood the implications of not claiming. This outbound contact was successful and found that most were in the process of claiming or did so immediately following contact. 4 claimants said they were not going to claim UC and their claims were then terminated at the deadline.

To summarise, of the 499 ETS notifications issued, 439 people have made a claim. Of those, 28 claimed having had a termination notice issued for their legacy claim. A further 51 people have had their legacy benefits / tax credits terminated with no subsequent claim to UC.

The research showed that some claimants are making a conscious decision not to claim believing they are not eligible or that an application is not worth the effort. It is now 2 months since terminations were issued and those former tax credit claimants have still not claimed UC. We continue to explore the reasons for this.

Applying the learning from Discovery

We are using the learning from Discovery to make improvements across the service to ensure that claimants can safely and smoothly make the move to UC.

It is clear from what we have learned so far that the Migration Notice is the central source of information for claimants and they refer back to it throughout the journey. We will therefore strengthen the message about why people need to move to UC as well as including more information about the process of claiming. In addition, there are opportunities to explain the claim process more clearly in online guidance signposted from the Migration Notice.

We will also identify opportunities to tailor the Migration Notice to different claimant groups to encourage claimants to take the appropriate action. This includes, for example, making the relationship with the tax credits renewals’ process clearer.

We have tested different approaches to reminders to learn how best to encourage people to claim UC before their deadline. This has included sending reminders at different points in the journey and across different channels. We are consolidating this learning, using data and feedback to ensure we send the right reminders at the right time with the right information via the right channel.

Transitional Protection is key for claimants in understanding what Move to UC means for them. However, there is limited understanding among claimants of how it is calculated and how it relates to their UC award. We will therefore improve messaging and communication about Transitional Protection throughout the journey so that claimants better understand how it works and what it means for them, both before they claim and when they receive their first UC payment.

Where claimants receive support from third parties, we are making improvements to the explicit consent model in UC, working closely with stakeholders to inform designs. We will continue to work with stakeholders to improve our understanding about how best to engage with and support some of the most vulnerable claimants and the role third parties can play in that. We will also look to harness stakeholders’ insight to identify opportunities to improve the overall process design.

Importantly, we will continue to look carefully at our arrangements for terminating a claimant’s legacy benefits. We do not do this lightly and are very carefully tracking all those whose benefits have been terminated. We have not terminated any ESA claimants’ benefits in the ETS cohort at the time of writing and are working hard to contact and engage with these individuals to encourage them to make a claim.

Next Steps

The Government remains committed to completing the Move to UC. By the end of 2024/25 we will have completed the moves of all legacy cases with tax credits (including those on both ESA and tax credits), all cases on Income Support (IS) and Jobseeker’s Allowance (JSA) and all Housing Benefit (HB) only cases.

That will allow HMRC to close down the tax credit system for those of working age and DWP to close down IS and JSA – generating savings for taxpayers. As part of that plan, in 2023/24 we plan to move cases that are solely in receipt of working tax credit and/or child tax credit, with the remaining tax credit cases (which also receive DWP benefits) and IS, HB and JSA in 2024/25. In the early part of 2023/24, we will be testing our ability to scale the approach that has been developed during Discovery and we will continue to learn and refine the process to ensure as many claimants as possible safely transition to UC.

Some 800,000 ESA cases will remain after 24/25, with the managed migration of these cases being delayed until 2028/29 as outlined in the recent Autumn Statement. The number of cases remaining is expected to fall to around 600,000 by 2028, taking into account natural migration resulting from changes of circumstances and claims coming to an end.

Annex A – Earliest Testable Service Management Information

| Point in journey – ETS Full Cohort | Households | Proportion |

|---|---|---|

| Migration Notices Issued | 499 | 100% |

| Total claimed or closed | 492 | 99% |

| Legacy benefits terminated without moving to UC | 51 | 10% |

| Move cancelled, excluded or deferred | 2 | 0% |

| Claimed UC, no statement | 2 | 0% |

| On UC, had a statement | 423 | 85% |

| Claimed UC on or after original migration deadline | 91 | 18% |

| Closed between claim date and first statement | 9 | 2% |

| Closed after having a statement | 4 | 1% |

| Other | 1 | 0% |

| Total still to claim | 7 | 1% |

| Point in journey – ETS Tax Credits Only | Households | Proportion |

|---|---|---|

| Migration Notices Issued | 240 | 100% |

| Total claimed or closed | 240 | 100% |

| Legacy benefits terminated without moving to UC | 49 | 20% |

| Claimed UC, no statement | 1 | 0% |

| On UC, had a statement | 181 | 75% |

| Claimed UC on or after original migration deadline | 45 | 19% |

| Closed between claim date and first statement | 5 | 2% |

| Closed after having a statement | 3 | 1% |

| Other | 1 | 0% |

| Total still to claim | 0 | 0% |

| Point in journey – ETS DWP Benefits | Households | Proportion |

|---|---|---|

| Migration Notices Issued | 259 | 100% |

| Total claimed or closed | 252 | 97% |

| Legacy benefits terminated without moving to UC | 2 | 1% |

| Move cancelled, excluded or deferred | 2 | 1% |

| Claimed UC, no statement | 1 | 0% |

| On UC, had a statement | 242 | 93% |

| Claimed UC on or after original migration deadline | 46 | 18% |

| Closed between claim date and first statement | 4 | 2% |

| Closed after having a statement | 1 | 0% |

| Total still to claim | 7 | 3% |

-

Legacy benefits comprise working tax credits (WTC), child tax (CTC) credits, housing benefit (HB), income-related employment and support allowance (ESA), income support (IS) and income-based jobseeker’s allowance (JSA). ↩

-

Completing the move to Universal Credit - GOV.UK (www.gov.uk) ↩

-

Claimants may make more than one call to the helpline, and each call may be for a different reason (hence, the percentages in Table 2 do not add up to 100%). ↩