Investing in your existing housing stock post pandemic

INVESTING IN YOUR EXISTING HOUSING STOCK POST PANDEMIC

We believe that the best solutions are yet to be discovered and the best outcomes yet to be delivered. That is why we prepare organisations for change and help them implement it. We do this through an intimate understanding of their business, a relentless focus on delivery, the use of techniques that challenge the status quo and bridge traditional disciplines. We provide a range of services to public and private organisations including project and programme management, property consultancy, change management and strategy development and strategic advice. Contact us to discuss a project.

Stock investment rapid assessment toolkit: 23 indicators to help get it right

The Covid19 crisis has disproportionately affected social housing tenants on any number of measures. The investment we make now will help build back better. How can we invest wisely?

‘Staying at home’, learning at home, working from home, is much harder if you live in an ageing, overcrowded flat with no outdoor space, poor insulation and no Wi-Fi. Councils and Registered Providers are already dealing with a plethora of challenges, including increased demand for temporary accommodation, welfare and ASB issues. Given the urgent fire safety improvements in the wake of the Grenfell tragedy (with the recently announced national Building Safety Regulator) and the need to transform energy efficiency to meet climate emergency commitments, the case for investment in our housing stock and surrounding estate environments has never been more pressing.

However, funding constraints have also increase given the cost of Covid19 and the regeneration cross-subsidy model now looks less viable than ever. Government investment may come as a result of a renewed preference for Keynesian economics, but how can you be sure you are investing the money well? Refurbish or redevelop? In this article we suggest the key factors in determining the right investment strategy in the short-term in order to provide the best outcomes for your residents in the long-term.

Now is the time to progress investment plans

The Local Authorities and Housing Associations we work with are continuously refining their investment plans across their existing housing stock, seeking to ensure the homes and surrounding spaces are safe, affordable and decent.

The government has set a legally binding target to reduce greenhouse gas emissions to zero by 2050. There is a passion to achieve this faster, with two thirds of local authorities having declared a Climate Emergency, and many setting more ambitious zero carbon targets up to 20 years ahead of the Government’s.

While the Government is consulting on its Future Homes Standard (which will require new homes to have 80% fewer carbon emissions by 2025), four out of every five homes that will be around in 2050 have already been built, so retrofitting existing homes to improve their energy efficiency will be key, with Councils and Registered Providers expected to ‘lead by example’ across their own portfolios. Any recovery plan worth its salt needs to retrain people with the skills to retrofit our homes and boost employment.

At the same time, landlords are also undertaking urgent works and addressing wider fire safety issues with their blocks following the Grenfell tragedy. The National Housing Federation suggested in the Guardian earlier this year that this could cost social landlords over £10bn. While the government has announced £1.6bn to support these works it seems there will still be a funding gap but also an urgency to get on with the works.

What is optimal for each estate and community?

Before making investments on the scale required, however, wider questions need to be asked about the right investment approach for each block or estate and the communities that live there. In some cases, an affordable refurbishment and retrofit will dramatically improve residents’ living standards, safety and environmental impact. In others, inherent design challenges, social issues and resident perceptions may make comprehensive redevelopment and renewal the better option.

It can take significant feasibility work and lengthy consultation with residents (potentially requiring a ballot if demolition is proposed) to fully establish the evidence base and determine the right approach for each estate, which creates an issue for Councils and other major landlords who need to rapidly prioritise investment across large portfolios.

We have been working with forward thinking local authorities and housing associations on systematic solutions to this conundrum. It is possible to develop a comprehensive framework to rapidly identify estates most and least suitable for redevelopment without undertaking any site-specific feasibility work.

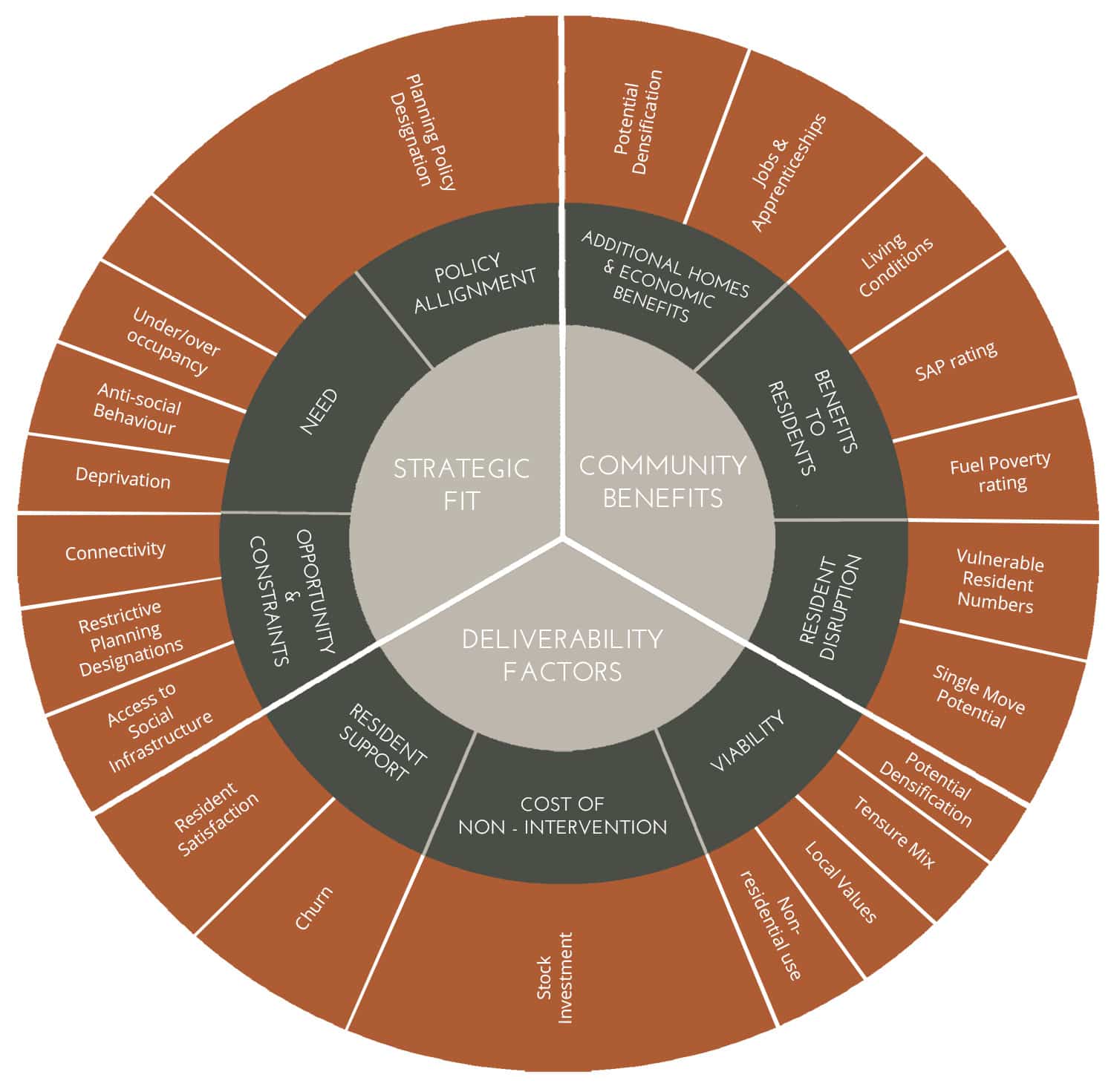

These frameworks combine stock data already held by social landlords with publicly available data sources to create an index of indicators, which inform our SIRAT tool (Stock Investment Rapid Assessment Toolkit). We have identified 23 indicators from resident satisfaction through local deprivation to local house prices. These assess the suitability for estate regeneration against strategic, financial and deliverability factors, including assessing potential investment requirements for fire safety and sustainability.

Three core considerations

First and foremost you need to consider the direct benefits to the resident community: who are you helping and how?

Second is the more pragmatic consideration of what is the art of the possible, as there will be particular constraints for each estate. Knowing these early on will help to avoid surprises and cost over-runs.

Finally consider the bigger picture of how the investment can achieve your city, town, borough or neighbourhood vision, meet the wider community and societal needs in your area, and boost employment; the strategic fit.

23 indicators to get the greatest impact from your investment

Within the three core elements are 23 detailed points for assessment that form the first (portfolio) stage in a progressive business case process. Results can be viewed graphically and mapped across the portfolio to give an instant picture of where investment in existing stock can safely be made and where a more comprehensive approach should be considered.

In order to translate the data behind the indicators into an investment case we advocate following the principles of the HM Treasury ‘5 cases’ model as a robust basis for decision making. Whatever process you prefer, you should never lose sight of the vital role decent housing plays in people’s wellbeing, and time is of the essence.

SIRAT indicators to inform housing stock investment. © Inner Circle Consulting.

Building Back Better

By taking a strategic approach and using these 23 indicators when consider estate investment, you will be better able to quickly assess all the relevant factors involved, make the right investment decisions and deliver the best outcome at pace.