Findings from WYSE Travel Confederation’s first COVID-19 Travel Business Impact Survey[1] have indicated that youth travel organisations experienced significant drops in business by the first week of March 2020 as a result of the global COVID-19 (Coronavirus) outbreak. Organisations based in Asia or receiving travellers from Asia, China in particular, were already reporting cancellations and slowed bookings for future stays at the end of January 2020. Perhaps needless to say, most youth travel organisations have expressed a pessimistic outlook for the remainder of 2020 – an outlook that has now most likely worsened since early March, the time of the first survey in this series. Put simply, yet powerfully by Phocuswire: “we haven’t been here before.”

Surely many of us agree that we’ve never seen or experienced anything like what is happening to the travel industry due to the halt of the movement of people across borders. This is not to mention changes to our local societies and cultures as we know them. In this third part of the WYSE Travel Confederation COVID-19 Travel Business Impact Series, we look back at what WYSE Travel Confederation learned from the global economic crisis of 2008 – 2010. How did the sectors of youth travel fare during that global economic crisis? What actions did businesses take in response to the crisis? What are the key characteristics of the youth travel marketplace that we should keep in mind as we look ahead?

Most importantly, we would like to hear from businesses about what they think might change about the youth travel marketplace by the time COVID-19 travel restrictions are lifted, health risks are reduced and confidence in travel resumes. With this in mind, we urge you to plan on participating in the April 2020 edition of the WYSE Travel Confederation COVID-19 Travel Business Impact Survey.

Global macro context

As UNWTO routinely states in its quarterly World Tourism Barometer, “Since the global economic crisis of 2009, international tourism has seen ten straight years of sustained, and sometimes remarkable growth, with an average 5% per year increase in arrivals through 2019. International tourism outperformed global GDP each year in terms of arrivals, and nine out of ten years in terms of international tourism receipts, reflecting the sector’s resilience and potential.[2] In other words, travel and tourism have done very well for ten straight years. The same trajectory of strong growth can be seen in the youth travel segment, the global marketplace of travellers aged 15 to 29. In 2015, UNWTO and WYSE Travel Confederation assessed the youth travel segment as a proportion of the global travel marketplace and agreed that the segment had grown from 20% to at least 23% of international arrivals.[3]

In January 2020, UNWTO projected 3% to 4% growth for international tourism this year.[4] This projection was revised in early March 2020 to negative growth of -1% to -3% and will likely be revised again in due course.[5]

Youth travel during the global economic crisis of 2008-2010

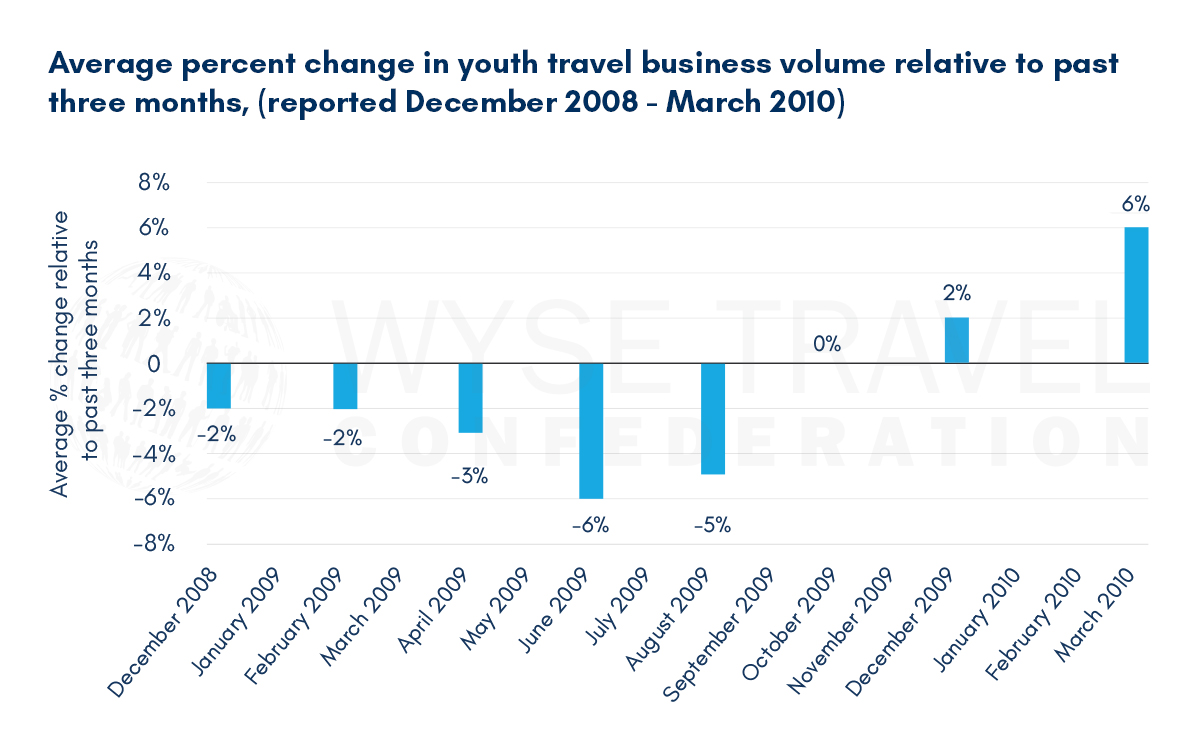

WYSE Travel Confederation conducted the Youth Travel Industry Monitor from December 2008 to March 2010 in response to the global economic crisis of that period. The survey routinely measured the impact of the economic crisis on youth travel organisations and generated insights on how organisations were responding to the challenging conditions. The aim was to help WYSE Travel Confederation members and the wider travel community make informed decisions and develop forward-thinking strategies. The survey was launched in December 2008, conducted quarterly throughout 2009 and completed at the end of Q1 2010.

Actions taken in response to global economic crisis vs global COVID-19 outbreak

The most important initial actions that businesses took in December 2008 to deal with the economic crisis were increasing marketing while also cutting costs, staff and prices. As things progressed in 2009, businesses focused on improving quality and looking for new opportunities and partnerships while adjustments to marketing were of the lowest priority. In contrast, the most important actions businesses reported taking in response to the global COVID-19 outbreak were modifying cancellation policies, reducing prices, and reducing capacity.

Change in business volume during the global economic crisis of 2008-2010

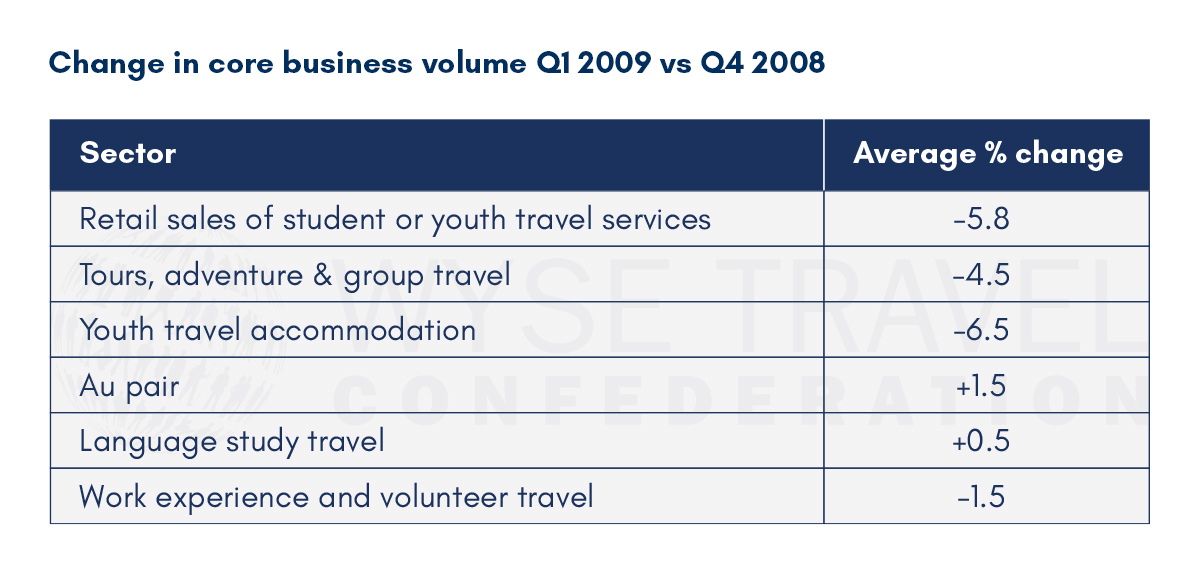

The overall average decline in business volume for the youth travel industry Q1 2009 vs Q4 2008 was around -2.4%. Suppliers of youth travel accommodation were particularly hard hit, as were retailers and tour operators. Small increases for au pair and language study travel suggested that some young people were looking for programmes that enabled opportunities to travel and continue educational activities while prospects in the job market were not ideal.

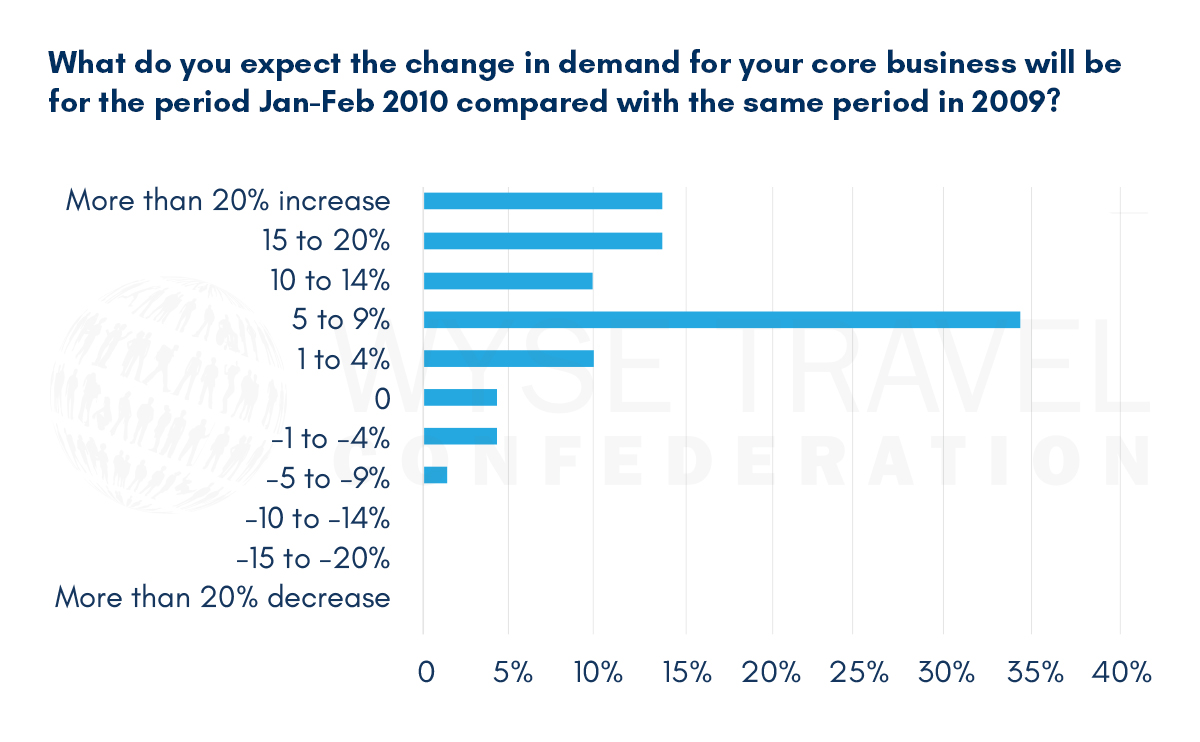

The outlook for 2010 at the end of 2009

Towards the end of 2009, respondents of the Youth Travel Industry Monitor were asked to indicate what they thought their business prospects were for the coming two months (January-February 2010) relative to the same period the year before (January-February 2009). There were clear indications that the youth travel industry expected a return to growth around this time, with about a third of organisations expecting growth of between 5% and 9%. Only 6% of youth travel organisations expected a decline. In the broader tourism context, UNWTO recorded 8% growth in international arrivals between 2009 and 2010 from 880 million to 948 million.

The resilience and stamina of the youth travel market

In the past, the youth travel industry has managed to adapt, innovate and be resilient during and after periods of crisis or disruption; WYSE Travel Confederation has seen this from business data collected in the past through surveys like the Youth Travel Industry Monitor. A less dire example is the hostel and youth travel accommodation industry’s adaptation to OTAs and Airbnb as seen in the STAY WYSE Hostel Booking Sources reports. WYSE Travel Confederation has also seen the market’s tendency towards resilience since 2002 in data collected from young travellers via the New Horizons Survey.

What are the unique characteristics of youth travel that have contributed to this market’s resilience in the past? Longer stays, higher spend, activity intense and travel motivations that go beyond leisure.

Young people are motivated to travel by opportunities to explore other cultures, experience everyday life in another country, and increase their knowledge; travel is more than just a vacation or holiday for many young people. On average, the youth traveller stays longer and spends more than a typical tourist or holidaymaker. The average length of stay for an international trip taken by youth aged 15 to 29 in 2017 was 52 days and the average trip expenditure was EUR 2,867. Furthermore, youth travel has been a growing market as far as volume and spend since WYSE Travel Confederation has been measuring it. 2017 expenditure represented an increase of 18% compared with 2012.[6]

Of course, the unique characteristics of each crisis have affected international youth travel and the different sectors within it in different ways. However, it could be argued that young travellers stand to play a crucial role in supporting economic recovery once COVID-19 travel restrictions are lifted, given that their top three in-destination activities generate direct spending to the small and local businesses that are currently being hit hard – enjoying cafes/restaurants, visiting historical sites/monuments and shopping.

Next survey in the COVID-19 Travel Business Impact Series

WYSE Travel Confederation will repeat the COVD-19 Travel Business Impact Series 3 -13 April 2020. As with past travel business crises that we have monitored, it is important for the industry to come together and take its collective temperature, so to speak. Given that youth aged 15 to 29 represent 23% of international arrivals, all travel businesses, regardless of their focus on youth-tailored travel products, are welcome to participate in the survey.

If your business would benefit from unique business insights on the youth travel market, industry representation for common business interests, and hopefully soon, new trading opportunities with international partners, we invite you to discover the resources of our global trade association for businesses serving young travellers.

To read the March 2020 survey analyses, please use the below links:

Youth travel anticipating 30% decrease in business for 2020

Business outlook by youth travel sector

[1]Data for this report were collected between March 3 – 9, 2020 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via web-based questionnaire (in English) titled Business impact survey – COVID-19. The survey attracted 599 responses from 73 countries. Four-hundred and twenty-one responses were retained for analysis. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products. All respondents were asked about the impact that the global COVID-19 (Coronavirus) outbreak has had on their core business in travel. Specific questions related to the change in business demand experienced in Q1 2020 vs the same period in 2019, the business outlook for the coming calendar year, top concerns for the immediate and long term, actions taken in response to COVID-19, and the impact of COVID-19 on group business.

[2]UNWTO World Tourism Barometer Volume 18, Issue 1, January 2020

[4]UNWTO World Tourism Barometer Volume 18, Issue 1, January 2020

[5]COVID-19: UNWTO calls on tourism to be part of recovery plans, 6 March 2020

[6]New Horizons IV: A global study of the youth and student traveller, July 2018, WYSE Travel Confederation.