In a recent global study of more than 33,000 people across 29 countries and 20 industries, Qualtrics XM Institute examined how consumers respond to a bad experience. The impact differs across industries, as we found that the percentage of consumers who report:

- Stopping or decreasing their spending after a bad experience ranges from a low of 36% for public utilities to a high of 59% for online retailers and 60% for fast food restaurants

- Stopping their spending after a very bad experience ranges from a low of 7% for public utilities to a high of 21% for credit card providers

- Decreasing their spending after a very bad experience ranges from a low of 22% for universities to a high of 44% for fast food restaurants

- Having a very bad experience ranges from a low of 7% for supermarkets and streaming media services to a high of 33% for government agencies

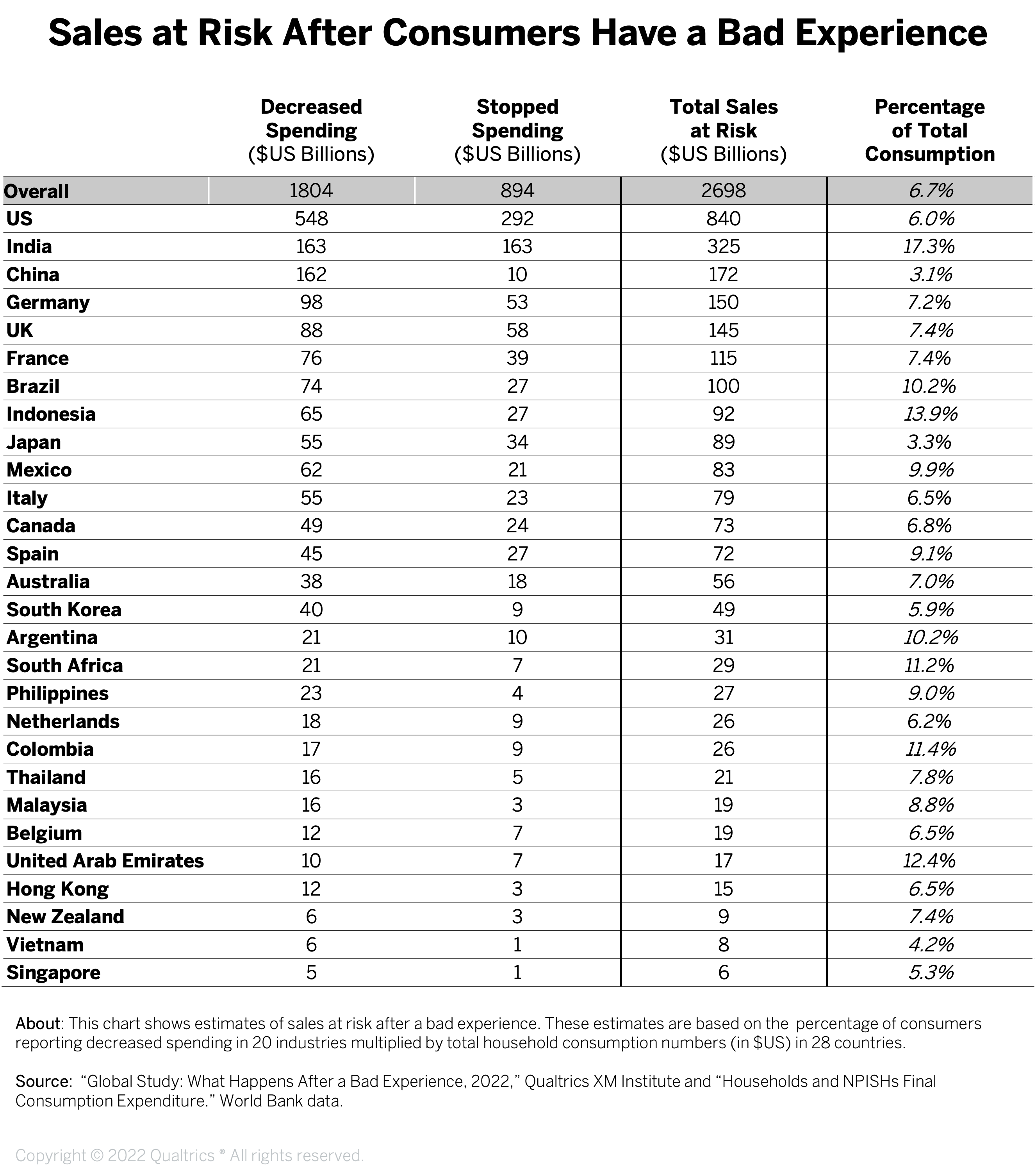

Cost of a Bad Experience Across 28 Countries

Based on our analysis of the data, we estimate that companies within those countries we examined that deliver very poor customer experiences are putting $2.7 trillion of sales at risk1. To estimate that number, we used:

- Frequency of bad experiences. On average, 16% of consumers report having a very poor experience with companies they interact with. Across countries, this percentage ranges from 7% in Japan to 48% in India.

- Spending changes after a bad experience. On average, 35% of consumers report decreasing their spending after a poor experience, and 15% report that they’ve completely stopped spending with the company. Across countries, the percentage of consumers who cut spending with a company (completely or partially) ranges from 18% in China to 67% in Columbia.

- Sales at risk (percentage). When we multiply the percentage of poor experiences and the percentage of consumers that have cut back or stopped spending, we end up with an average level of “sales at risk” of 8%. Across countries, the “sales at risk” range from 3% in Japan and China to 17% in India.

- Sales at risk (currency). To translate the percentages into currency, we multiplied the sales at risk percentages for each country by household consumption numbers in $US from The World Bank. Across 28 countries, we found a total of $2,694 billion of sales at risk, ranging from $6 billion in Singapore to $840 billion in the U.S2.

The Global Impact: $3.1 Trillion at Risk

Now that we’ve estimated sales at risk in 28 countries, let’s examine the impact globally. To do that, we went back to The World Bank data and calculated that those 28 countries represent 85% of global household consumption. If we assume that the sales at risk data for the rest of the world are equivalent to the average of our 28 countries, then we find that $3.1 trillion of sales are at risk from bad experiences every year. It breaks down like this:

- Consumers will completely stop spending $1.0 trillion with companies that provide a very bad customer experience.

- Consumers will cut back on $2.1 trillion of spending from companies that provide a very bad customer experience.

Changes from 2021

Last year we estimated that there was $4.7 trillion at risk. What changed?

- The methodology. We added 11 countries and 15,000 consumers to our study and expanded our coverage from 18 to 20 industries. This broader study allows us to better estimate the worldwide number. Also, the new industries we added (auto dealers, electronics makers, and hotels) had below-average sensitivity to bad experiences.

- Fewer bad experiences. Eleven of the 18 countries that are in both studies had a drop in reported bad experiences. We saw the largest drops, about 8 percentage-points, in Malaysia and the U.S.

- Slightly less sensitivity. Across the 18 industries that were in both last year and this year, the average percentage of consumers who either stopped or decreased their spending after a bad experience decreased by one percentage-point. We saw double-digit decreases (in spending changes) for parcel delivery services, property insurance, and supermarkets, while we also saw double-digit increases for universities.

The bottom line: Bad experiences can be very, very costly!

Bruce Temkin, CCXP, XMP is the Head of Qualtrics XM Institute

1 Our global study examined the percentage of consumers who have had bad experiences across 20 industries and how their spending has changed based on those experiences.

2 Our analysis of global sales at risk excludes Taiwan, whose household consumption data is not included in The World Bank database.